Volatility, a key metric for evaluating changes in exchange rates, encompasses the frequency and magnitude of price fluctuations. Traders and investors use this indicator to assess risk, with high volatility occurring when prices undergo significant shifts within a specified timeframe.

The extent of volatility offers insights into market conditions, particularly when there is a surge in interest from bullish or bearish participants, leading to increased volatility. While heightened interest poses greater risks, it also generates more trading opportunities.

In this article, we will explore the domain of highly volatile currency pairs frequently encountered by traders in the forex market.

What are the most volatile forex currency pairs?

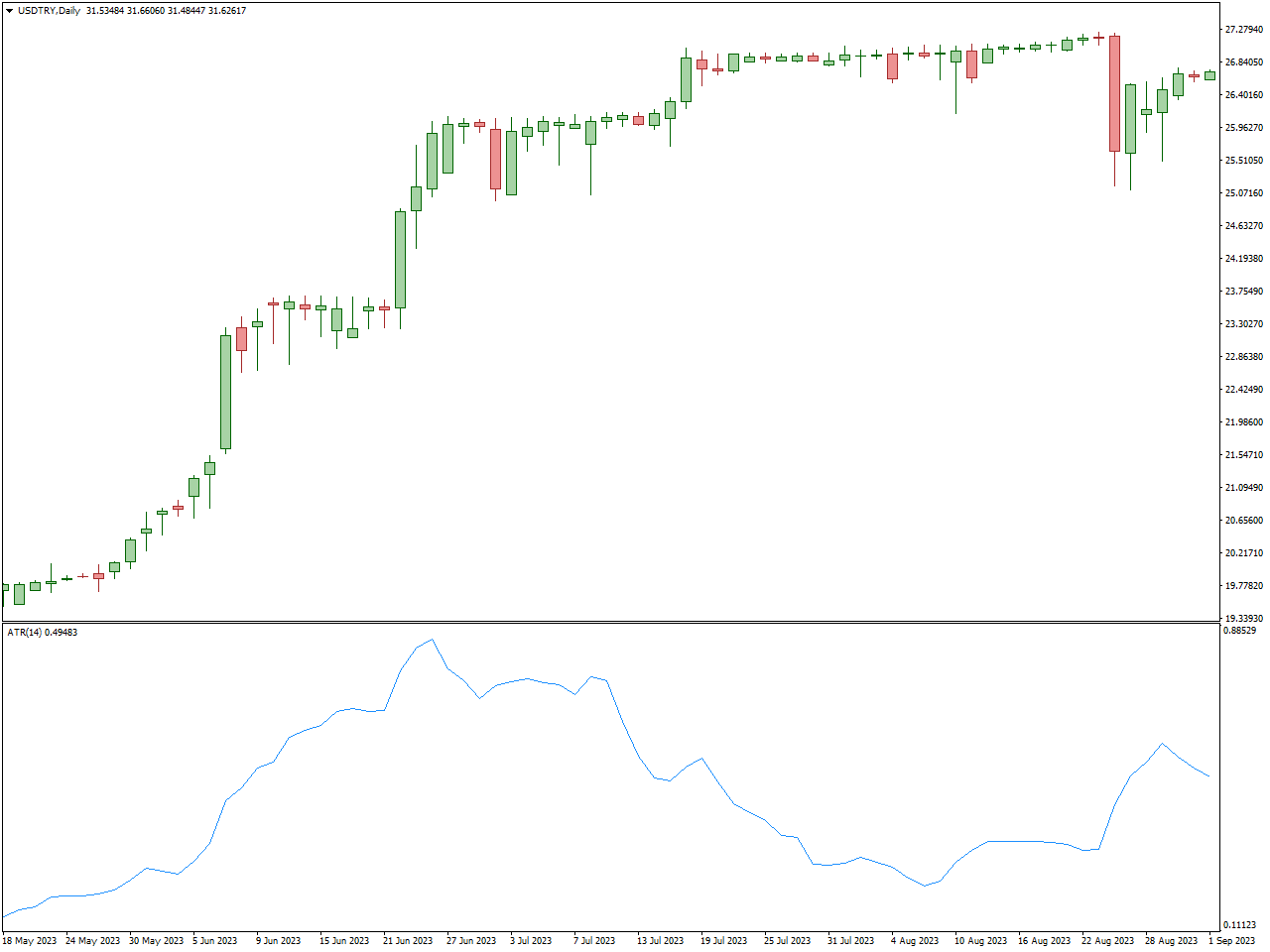

USD/TRY (US Dollar/Turkish Lira)

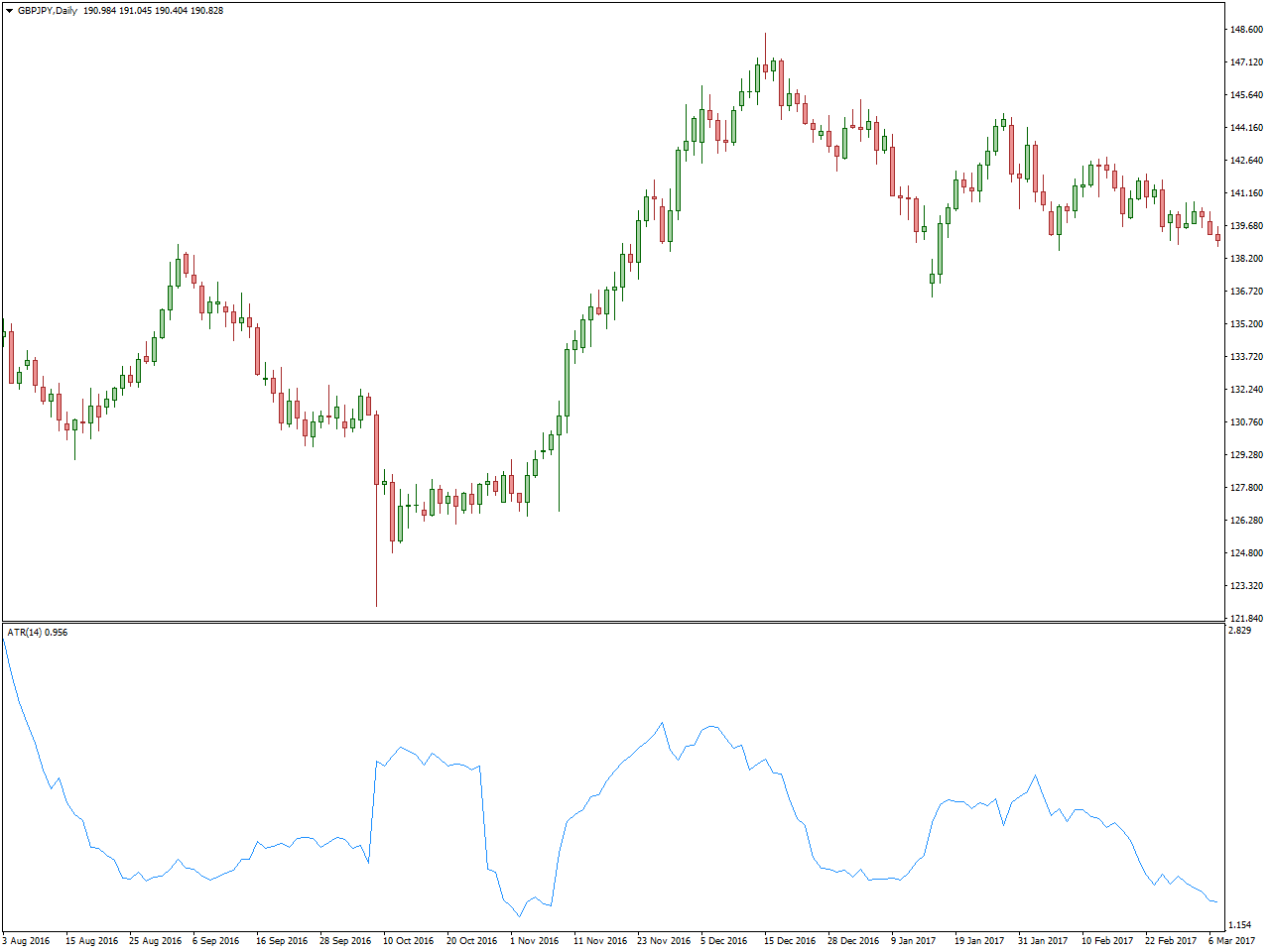

GBP/JPY (British Pound/Japanese Yen)

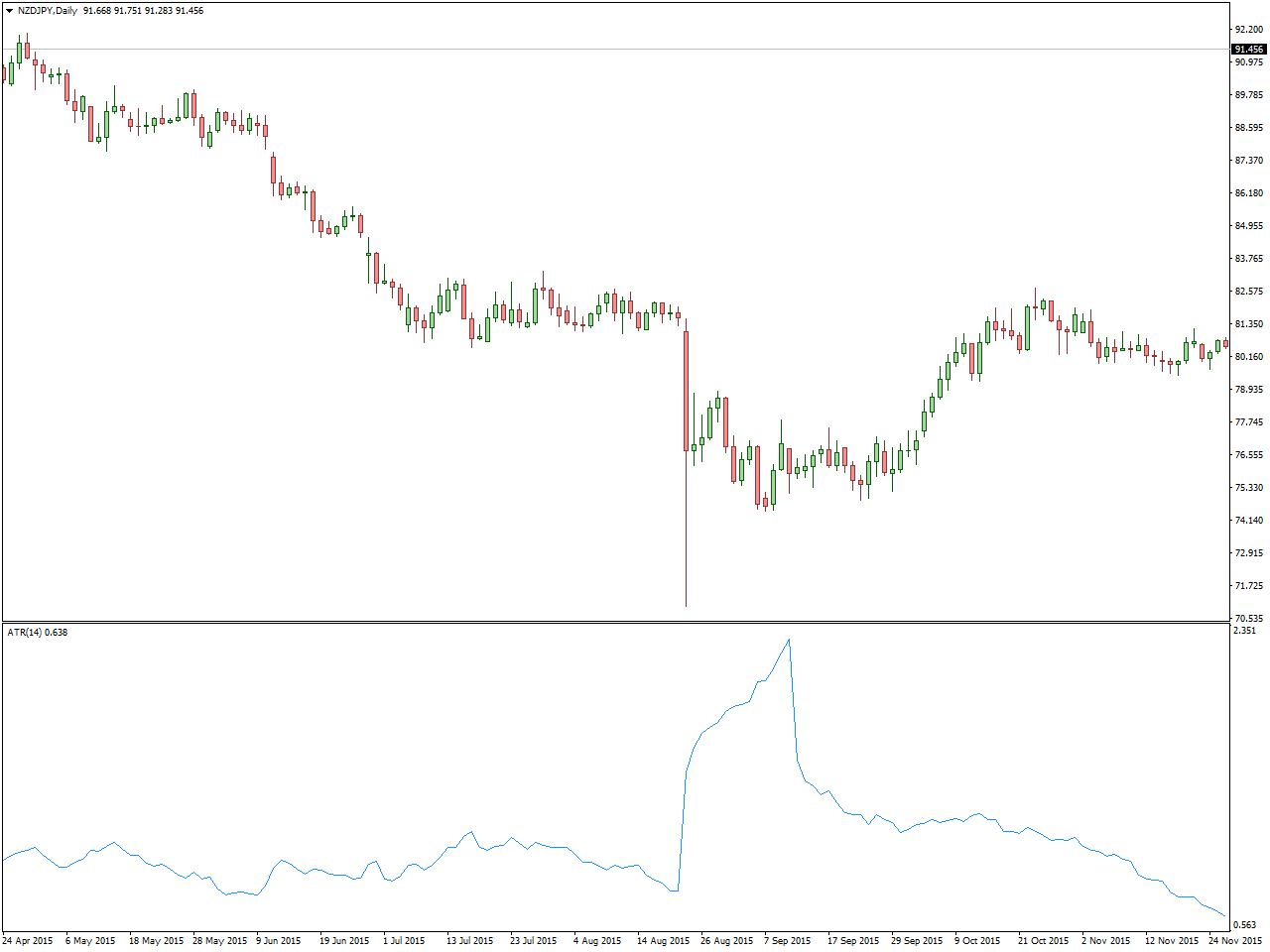

NZD/JPY (New Zealand Dollar/Japanese Yen)

What factors affect the volatility in currency trading?

Volatility is a dynamic factor that fluctuates across both short-term and long-term timeframes. Profiting from these variations necessitates a keen understanding of the intricate details associated with each currency pair and their rapid movements.

Several factors influence the volatility of currency pairs:

- Economic factors, encompassing shifts in interest rates, employment figures, inflation rates, and unexpected actions taken by financial institutions. These elements can induce short-term fluctuations in prices.

- Geopolitical events have historically impacted the currencies of developing nations. For instance, recent movements in Russia triggered a crisis in early 2022, resulting in the Russian ruble’s depreciation against the dollar by more than 50%. Manual interventions were necessary to stabilize the situation, achieved by infusing liquidity into the system.

- Unforeseen natural disasters, like those experienced in Australia, can directly impact statistical data and contribute to economic challenges.

- Liquidity, determined by the volume and nature of trading activities, is a crucial factor. Higher trading orders tend to reduce volatility. While purchasing exotic currencies is relatively swift, selling them poses challenges as they may not be favored by many traders. Unexpected news can swiftly alter market direction, prompting a collective interest from traders in specific currency pairs. In such instances, sellers may turn into buyers or vice versa, leading to an escalation in volatility.

Difference between liquidity and volatility

Liquidity and volatility, crucial components in financial markets, are interconnected yet distinct, shaping trading conditions and investment strategies. Liquidity, representing the ease of buy or sell an asset without significant price shifts, is evident in major currency pairs and established stocks, allowing traders to enter or exit positions promptly at predictable prices.

Volatility, measuring the variation in a trading price action series over time, serves as a gauge for uncertainty or risk in an asset’s price movements. High volatility involves frequent and significant price fluctuations, while low volatility leads to more consistent and predictable trends. Traders and investors consider volatility in decisions related to risk management, position sizing, and choosing trading strategies. Cryptocurrencies, known for their inherent volatility, offer both opportunities and risks for market participants.

Despite their differences, liquidity and volatility are inherently connected. During heightened volatility, liquidity may decrease as participants become reluctant to trade amid increased uncertainty, leading to wider bid-ask spread and potentially higher trading costs. Conversely, in periods of low volatility, market liquidity thrives as trading activities become more structured and less erratic. Striking a balance between these dynamics is crucial for traders, requiring thoughtful consideration of volatility’s impact on liquidity and the adept adaptation of strategies to navigate diverse market conditions effectively.

How to trade currency pair volatility

For traders eager to initiate a trading endeavor while factoring in volatility, here are some pointers:

Prioritize Trailing Stop over Stop Loss:

- Emphasize the importance of a trailing stop, which tracks the price range along the forecast. This approach allows for maximizing profits amidst volatility with minimal risk, even in the event of a trend shift. Note that a trailing stop set in your trading platform may not execute if there’s a connection failure to the server, leaving the trade open. Opting for a Virtual Private Server (VPS) can be a solution to address this concern.

Implement Sound Strategies:

- Consider employing strategies that involve trading within or along the channel, and initiating trades during a volatility peak following a period of flat trading.

Assess Trend Strength Using Volatility Calculators and ATR:

- Gauge the strength of a trend by utilizing a volatility calculator and the Average True Range (ATR). For instance, if the price has surged half the range since early morning, predicting a potential halt and reversal at that point becomes plausible.

Acknowledge Trading Risks during Strong Movements:

- Exercise caution when dealing with exceptionally strong market movements. Be prepared for potential challenges like large spreads, swaps, and slippage, as these issues may arise with highly volatile assets. Accepting and managing these risks is crucial for prudent trading.

Indicators that you can use

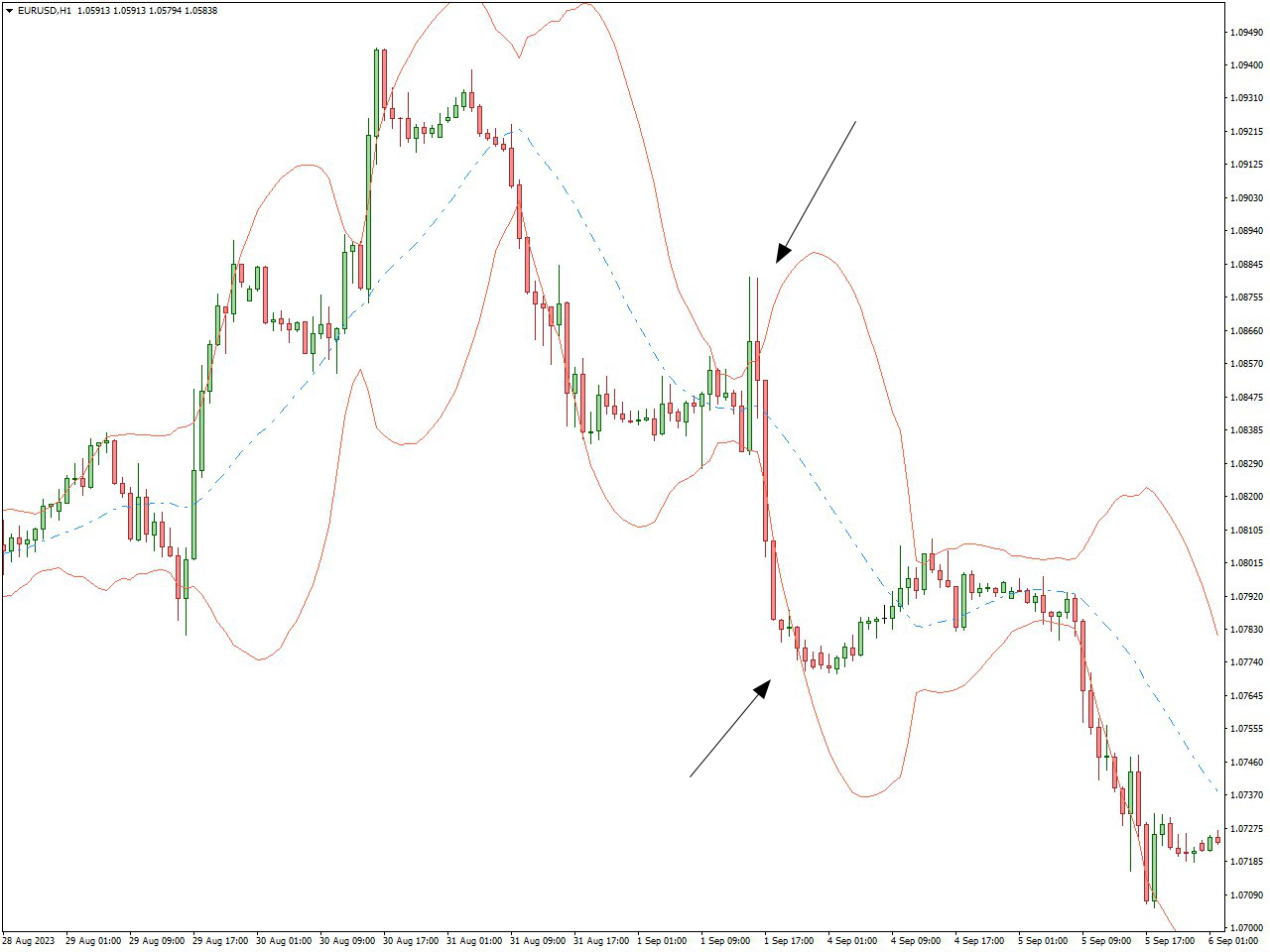

- Bollinger Bands:

- Useful for identifying overbought or oversold conditions, Bollinger Bands are formed by a middle band (usually a simple moving average) and two outer bands representing standard deviations. Widening bands indicate increased volatility.

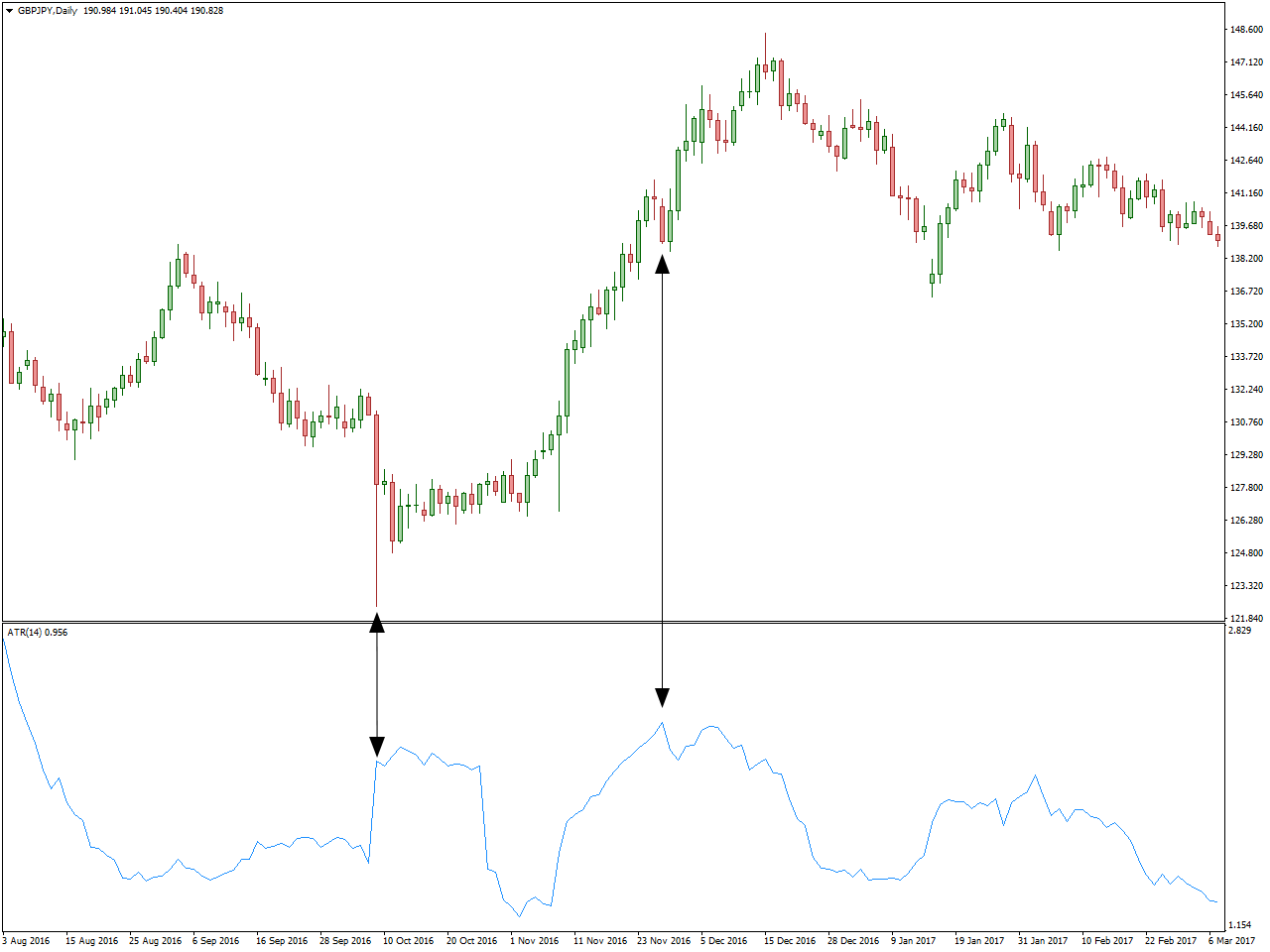

- Average True Range (ATR):

- ATR measures market volatility by calculating the average range between high and low prices. Traders can use ATR to set appropriate stop-loss order, considering the current market conditions.

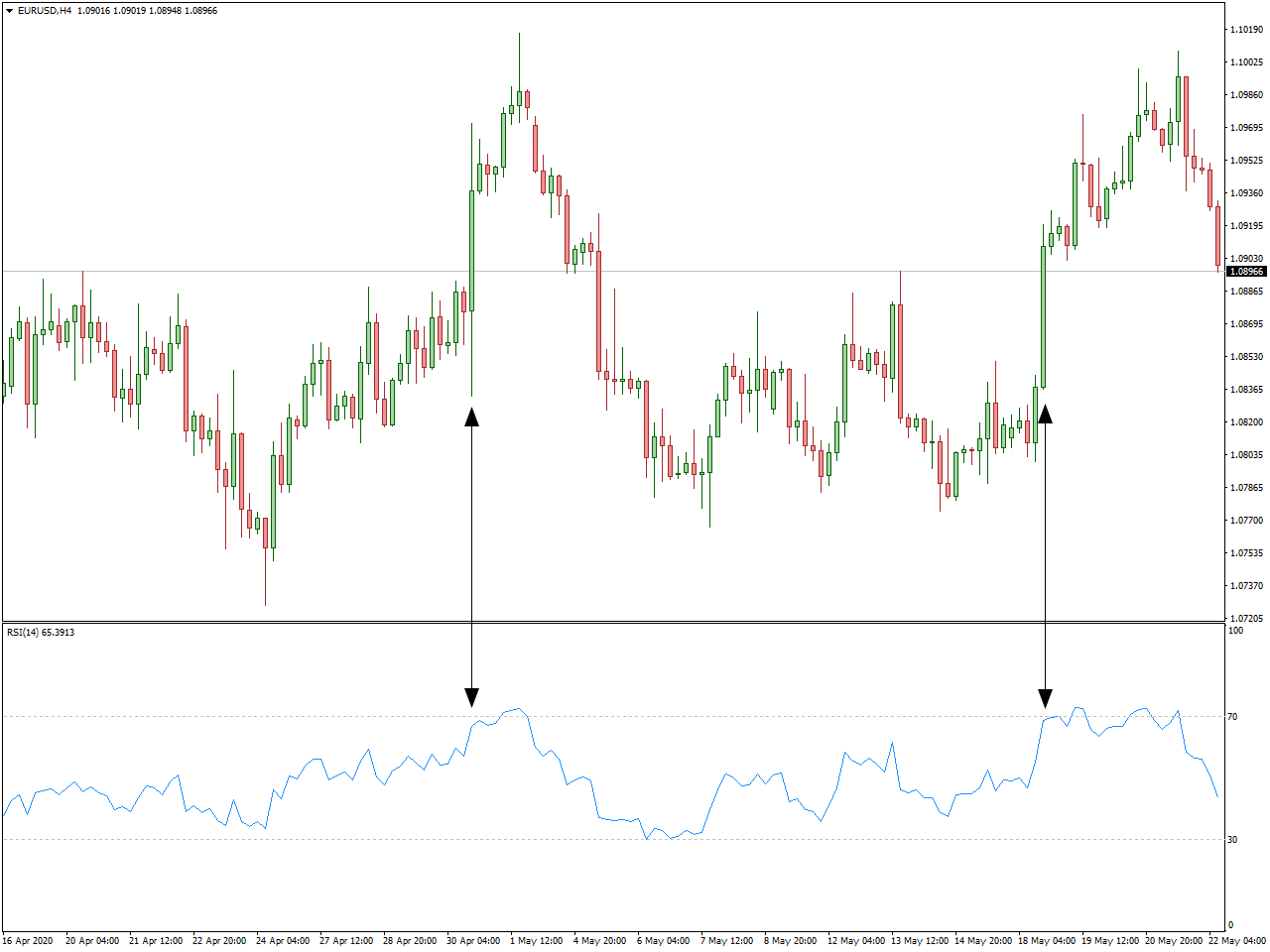

- Relative Strength Index (RSI):

- RSI is a momentum indicator that helps identify overbought or oversold conditions. Particularly valuable in volatile markets, RSI can signal potential reversal points or confirm the strength of a trend.

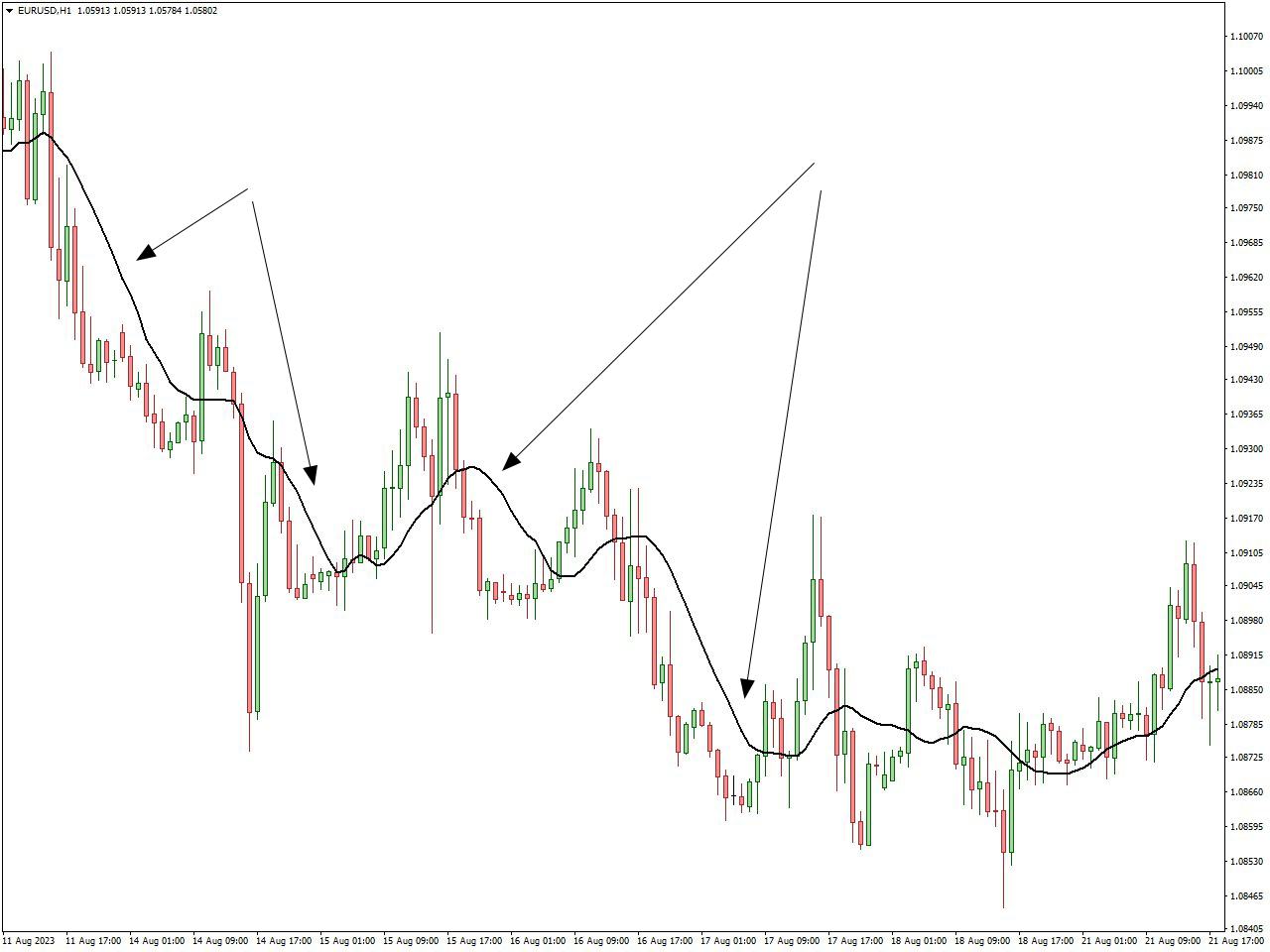

- Moving Averages (MA):

- Both Simple Moving Averages (SMA) and Exponential Moving Averages (EMA) can be employed to smooth price data and identify trends. Crossovers and the slope of the moving average can offer insights into the direction and strength of the trend.

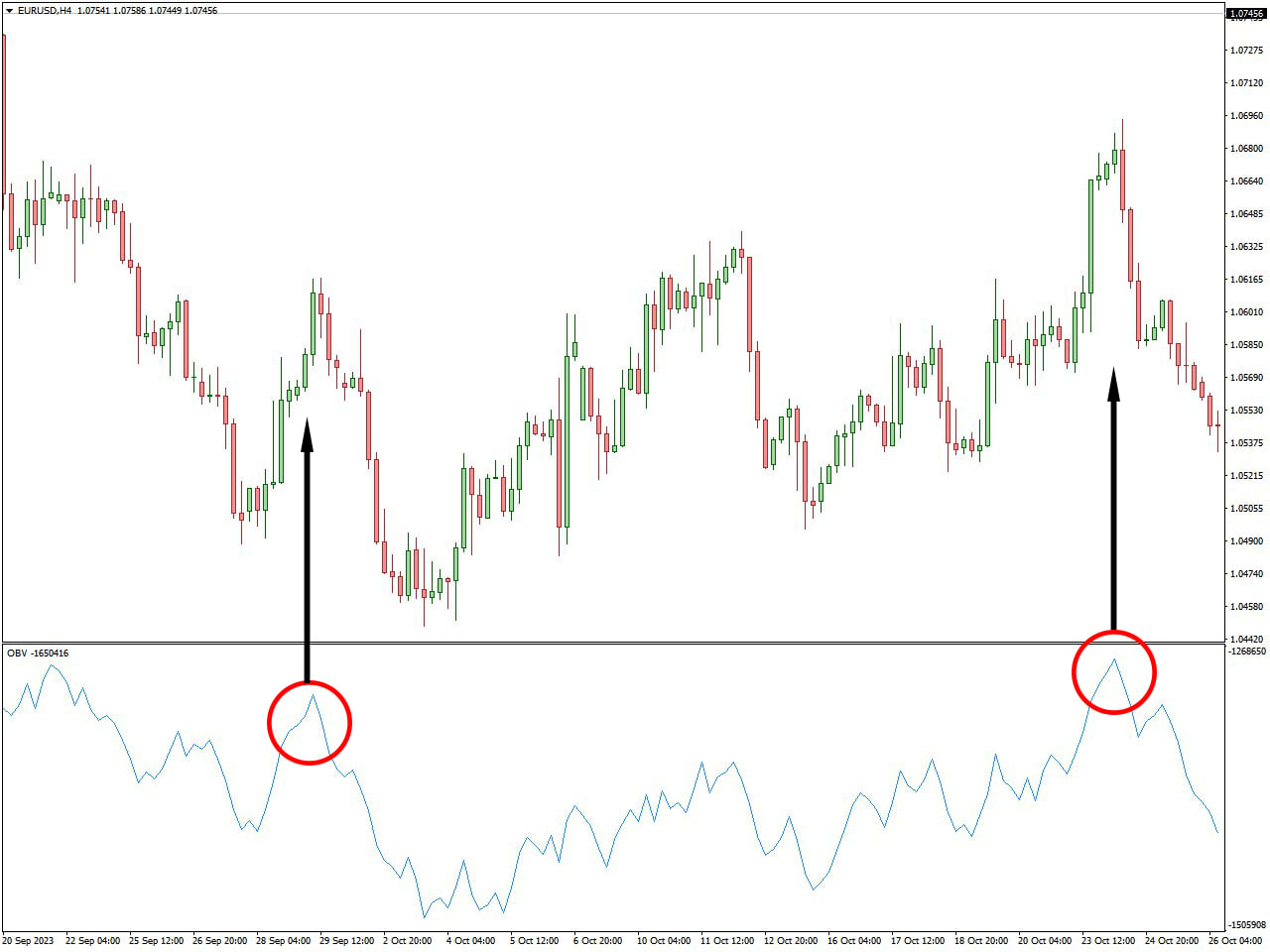

- Volume Indicators:

- On-Balance Volume (OBV) or volume bars provide insight into the strength of a price movement. Sudden increases in trading volume can indicate the beginning or continuation of a trend, a crucial consideration in volatile markets.

Key things traders should know about volatility

- Significant news events, such as Brexit or trade wars, can profoundly impact a currency’s volatility.

- Economic data releases also play a role in influencing volatility, and traders often use economic calendars to stay ahead of such events.

- Volatile currency pairs still adhere to technical aspects of trading, including support and resistance level, trendline, and price patterns.

- Traders can effectively navigate currency pair volatility by employing technical analysis in conjunction with strict risk management principles.

- Staying updated on the latest forex pair news, analysis, and rates is crucial for predicting possible changes in volatility.

- Comprehensive trading forecasts are provided to assist traders in making informed decisions and navigating the dynamic forex market.

Participating in the trading of both volatile and stable currency pairs involves navigating distinct market conditions, each requiring specific strategies and considerations. When engaging with volatile currencies like exotic pairs or cryptocurrencies, traders encounter the potential for rapid and substantial price fluctuations. In these markets, a heightened emphasis on technical indicators, a robust risk management strategy, and swift decision-making becomes crucial due to elevated risk and volatility. Although the allure lies in the potential for significant profits, it comes with increased uncertainty, underscoring the importance for traders to stay well-informed about market events and dynamically adjust their strategies.

On the other hand, trading stable currencies, typically major pairs such as EUR/USD or USD/JPY, entails handling lower level of volatility and more predictable price action. These currencies often respond to stable economies, central bank policies, and established market trends. Traders focusing on stable currencies might opt for longer-term strategies, relying on fundamental analysis and economic indicators. While the potential for substantial profits may be less compared to volatile currencies, the reduced risk can be attractive to those inclined toward a more conservative trading approach.

The decision to trade volatile or stable currencies ultimately depends on a trader’s risk tolerance, time horizon, and market preferences. Traders seeking excitement, quick trades, and higher risk-reward ratios may find volatile currencies appealing. Conversely, those prioritizing stability, a measured approach, and potentially lower risk may lean toward trading stable currencies. Regardless of the chosen path, maintaining discipline, implementing effective risk management, and continuously adapting to market conditions remain crucial for success in the dynamic realm of forex trading.

Conclusion

Engaging in forex trading, particularly with volatile currency pairs, entails a mix of excitement and risk. Traders must grasp the factors influencing forex volatility and develop effective strategies to navigate the dynamic landscape of forex trading. Whether dealing with major or exotic currency pairs, possessing a comprehensive understanding of currency pair volatility and a resilient trading strategy is pivotal for capitalizing on price fluctuations and potentially yielding profits.