Smart money strategies transcend superficial understanding, delving deep into the intricate mechanisms steering market dynamics. Within this extensive guide, we embark on a voyage to demystify the intricacies of smart money, furnishing you with indispensable insights and strategies vital for traversing the intricate landscape of financial markets.

What is the Smart Money?

In trading, “smart money” refers to the combined activities of prominent institutional investors, hedge funds, investment banks, and other significant players in the financial arena. These entities typically boast considerable resources, access to sophisticated market analysis tools, and specialized expertise. The term “smart money” is commonly used in day trading circles to depict the maneuvers of these seasoned forex market participants, who are believed to wield substantial insight and influence over market dynamics.

The conduct of smart money investors is closely scrutinized by traders and analysts because it is thought to offer valuable indications about market trends. For instance, if smart money is amassing shares of a specific stock, it may suggest their anticipation of future price appreciation. Conversely, if smart money is divesting from positions, it could imply an imminent downturn.

Beginners often endeavor to trail the path of smart money by scrutinizing variables such as volume patterns, alterations in institutional ownership, options activity, and positioning within futures markets. By pinpointing the direction of smart money flow, traders may seek to synchronize their own positions with these movements to seize potential market opportunities.

Nevertheless, it’s crucial to acknowledge that while smart money can furnish valuable insights, it is not infallible, and its actions may not consistently forecast market shifts accurately. Additionally, smart money investors might occasionally employ deceptive maneuvers to misguide other market participants. Hence, traders should employ a blend of analytical methodologies and risk management strategies to execute well-informed trading decisions.

Why SMC is Important in Forex Trading

The importance of SMC in forex trading stems from its ability to offer traders a systematic approach to understanding market dynamics and making well-informed trading choices. Here are several reasons why SMC holds significance in forex trading:

Insight into Institutional Activity: SMC enables traders to delve into the actions of major financial players, including central banks and hedge funds. Through concepts like order blocks, traders can decipher how these entities amass or distribute assets, aligning their strategies with smart money movements.

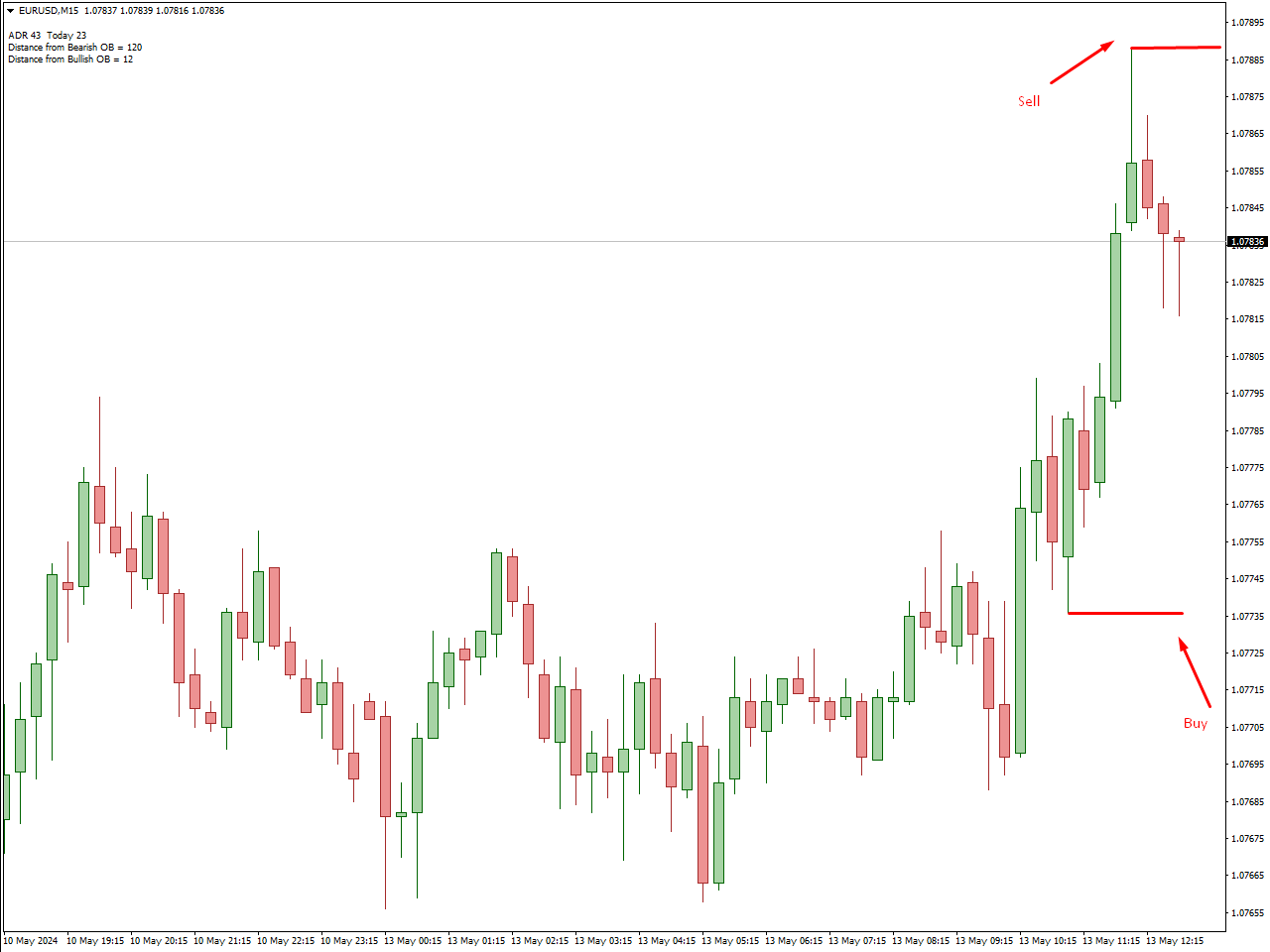

Identification of Key Market Levels: SMC places emphasis on pinpointing crucial support and resistance levels using tools like order blocks and fair value gaps. These levels act as pivotal decision points for traders, aiding in the determination of optimal entry and exit positions for trades.

Recognition of Market Trends: SMC equips traders with tools such as Break of Structure (BOS) and Change of Character (ChoCH) to detect shifts in market trends. Early identification of these changes empowers traders to capitalize on trend continuations or reversals, thereby boosting profitability.

Enhanced Trade Timing: By integrating concepts like liquidity and trendline analysis, SMC assists traders in refining their trade timing. Understanding where substantial trade volumes are likely to occur enables traders to execute positions more effectively, thereby reducing slippage and maximizing profits.

Smart Money Terminologies and Techniques

Rather than merely theoretical, SMC represents a comprehensive trading methodology with its distinct terminologies and concepts. Let’s delve deeper into some of the key concepts and trading techniques within SMC.

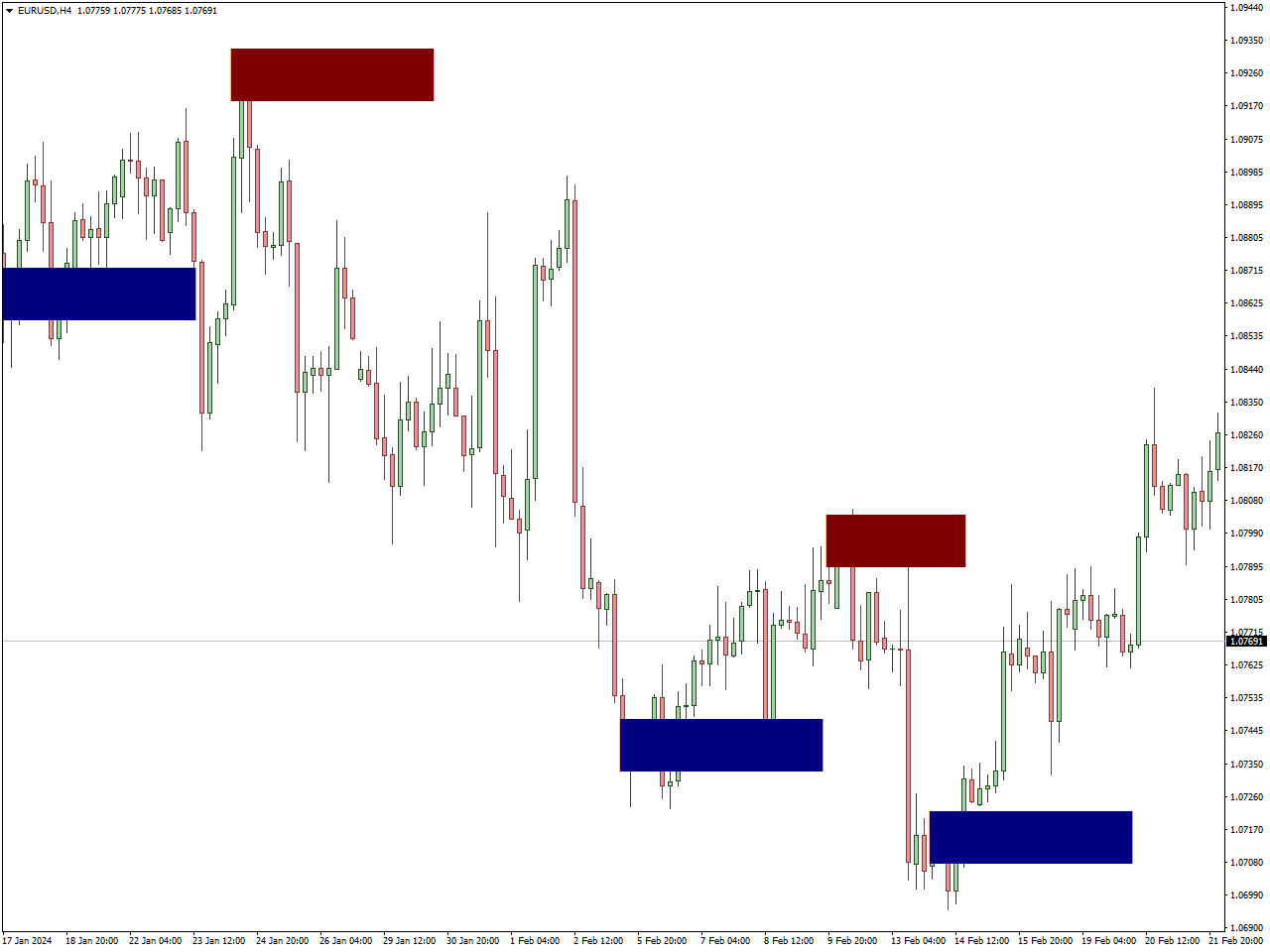

Order Blocks (OB)

This concept lies at the core of understanding SMC. Order blocks denote a market scenario wherein central banks, governments, and major financial institutions accumulate or distribute substantial amounts of an asset through significant orders. This strategic maneuver allows them to acquire the asset without inciting panic or excessive volatility in the market.

On price charts, order blocks typically manifest as a ranging market. However, to accurately pinpoint order blocks in the market, additional tools such as level 2 market data and volume indicators are essential.

You also have the option to verify it independently by utilizing Order Block Breaker indicator.

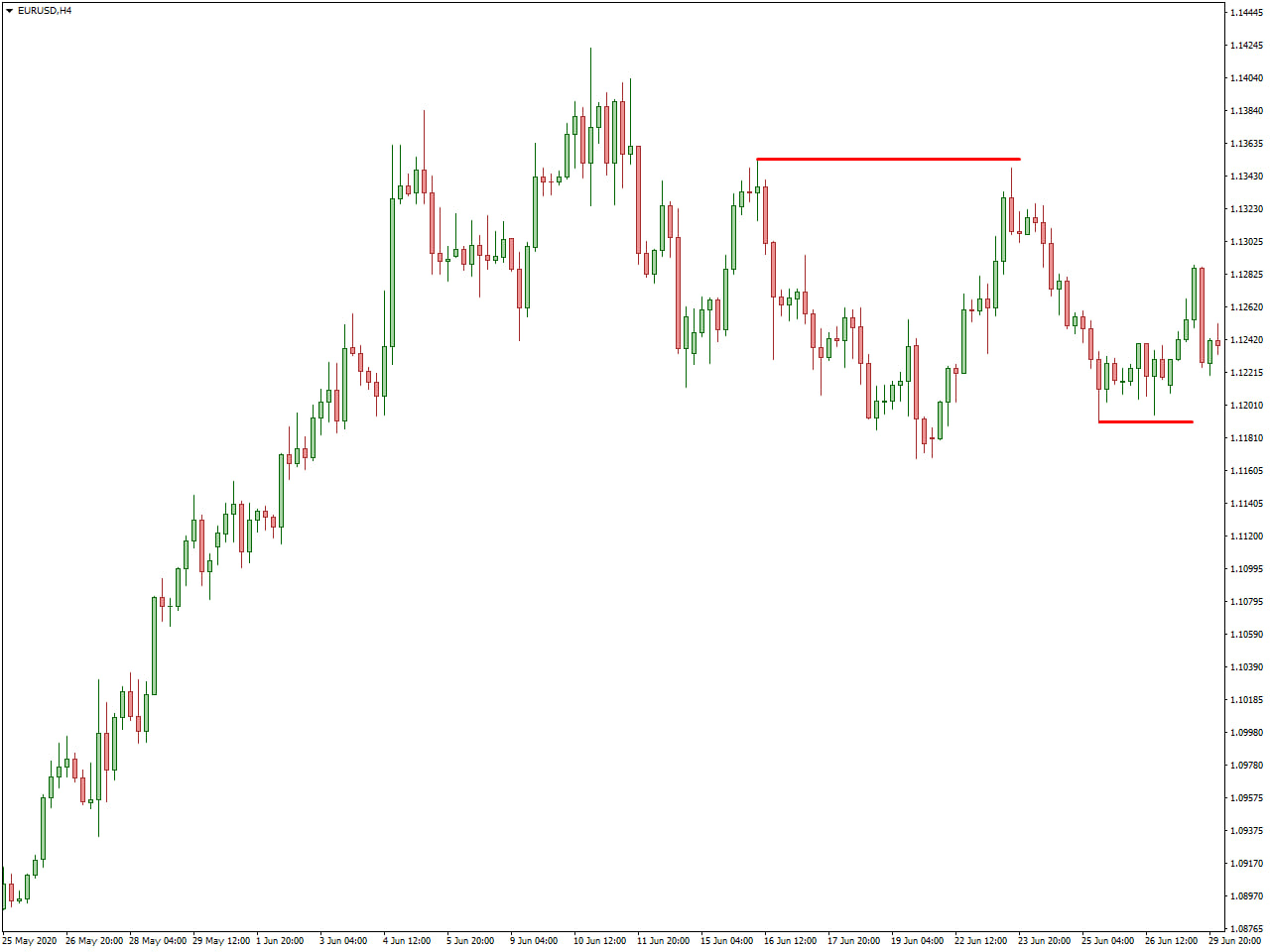

Fair Value Gaps (FVG)

Fair value gaps, also known as FVGs, constitute a distinctive trading concept observed when the market swiftly transitions from one price level to another, often leaving gaps on price trends. SMC traders closely monitor these gaps as they can signal significant shifts in market sentiment.

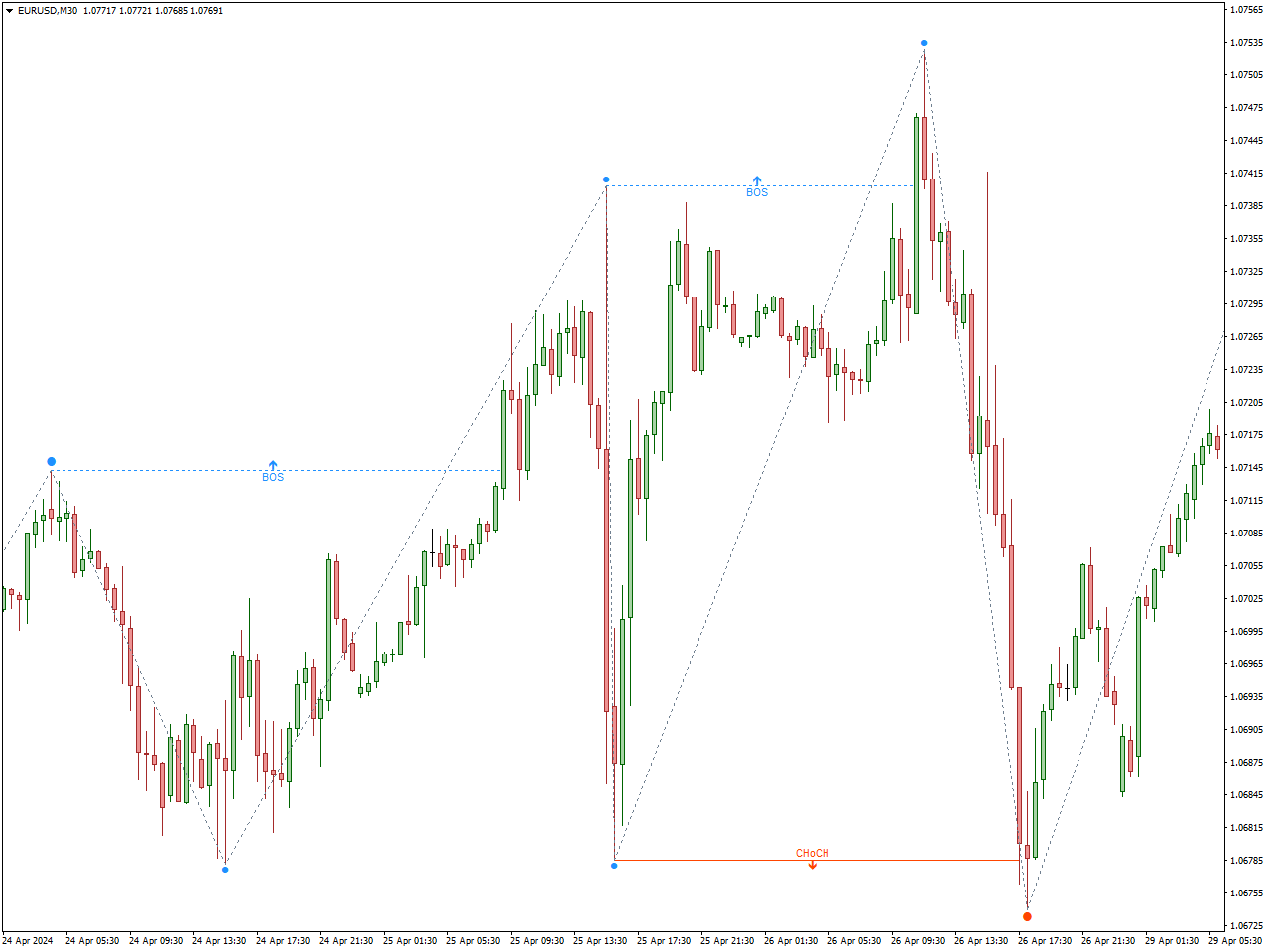

Break of Structure (BOS)

The break of structure centers on identifying alterations in the market’s overarching trend. A break of structure occurs when the price establishes a new high or low while surpassing prior levels.

Change of Character (Choch)

Change of Character, or Choch for short, denotes a scenario where the market’s behavior undergoes an abrupt shift. It entails a sudden fluctuation in volatility, volume, or price action, indicating potential weakness in the current trend and a potential reversal.

You have the additional option of conducting a self-assessment by employing the Bos & Choch indicator. This tool enables you to independently verify the data, allowing for a more comprehensive understanding of the market dynamics.

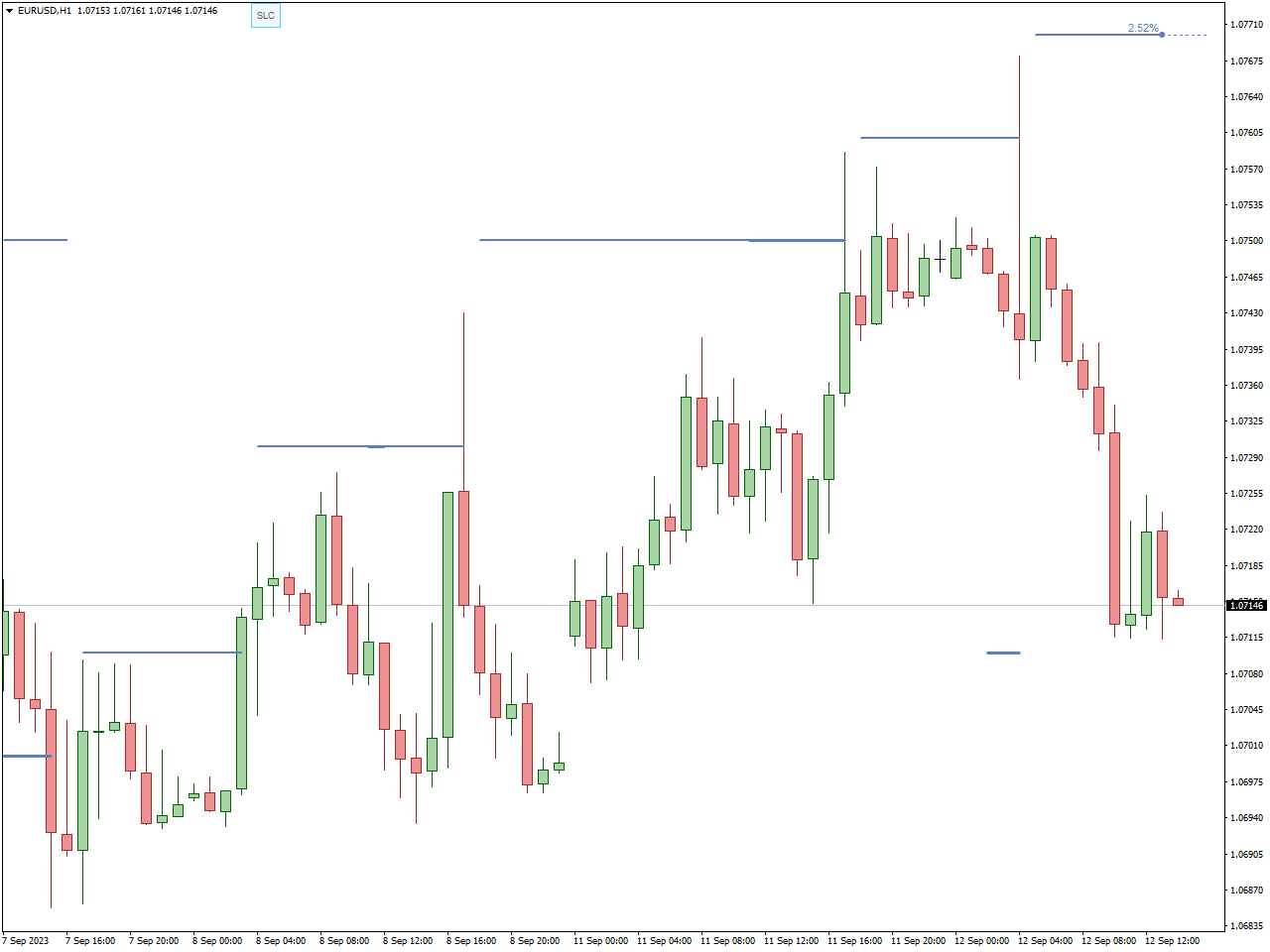

Liquidity

Liquidity stands as a pivotal element in SMC trading. It denotes a point in an asset’s price where orders are poised either above or below, awaiting execution. Various forms of liquidity exist, including trendline liquidity, buy side liquidity, sell side liquidity, double tops, double bottoms, and more.

How to trade?

Identifying Market Trends through Structural Breaks (BOS) and Changes of Character (ChoCH)

You can also use FXSSI.StopLossClusters Indicator which provides traders with a valuable technical tool for identifying order blocks within the market. By utilizing this indicator, traders can gain insight into areas where significant clusters of stop-loss orders are located, indicating potential zones of interest for institutional traders and market participants.

Order blocks are areas with large volumes of stop-loss orders, indicating key support and resistance levels. As prices approach these zones, they encounter increased liquidity, leading to potential significant price movements.

The FXSSI.StopLossClusters Indicator visualizes these order blocks on charts, helping traders identify clusters of stop-loss orders and make informed decisions on entry and exit points.

Trend continuation is marked by a Break of Structure (BOS), where prices exceed significant highs or lows, indicating a new market direction. A Change of Character (ChoCH), showing sudden market behavior shifts, can confirm this trend. Recognizing these helps traders align with market momentum.

Next, traders identify active institutional areas, often signaled by BOS or ChoCH. They focus on the range that initiated the shift, especially if there’s a pronounced move creating a fair-value gap or aligning with a breaker block. Liquidity near these points further validates the order block’s significance, crucial for understanding where significant trade volumes occur and where prices may revisit before continuing the trend.

Locating Entry Points

Upon identifying an order block, the attention of traders swiftly transitions to pinpointing a strategic entry point, crucial for both short and long positions. Traders commonly opt to position limit orders precisely at the edge of the block, leveraging key candlestick patterns like hammers, shooting stars, or engulfing candles to signal potential trend continuations, thus facilitating entry into the market. However, the arsenal of trading tools extends beyond candlestick patterns, encompassing Fibonacci retracements and indicators, which play pivotal roles in pinpointing opportune entry points, particularly in alignment with the prevailing market sentiment.

Common mistakes to avoid in SMC

Misinterpreting Institutional Activity: Misunderstanding the actions of major financial institutions can result in misguided trading decisions. It’s crucial to fully grasp the context surrounding order blocks and institutional behavior to avoid trading against smart money movements.

Neglecting Risk Management: Failure to implement proper risk management techniques can expose traders to significant losses. It’s essential to establish stop-loss levels, adhere to position sizing principles, and diversify portfolios to effectively mitigate risks.

Overlooking Market Context: Solely relying on SMC indicators without considering broader market conditions can be detrimental. Analyzing factors such as economic data releases, geopolitical events, and overall market sentiment is vital for making well-informed trading decisions.

Relying Solely on Indicators: Depending exclusively on SMC indicators without integrating fundamental and technical analysis can lead to incomplete trading strategies. It’s crucial to incorporate indicators as part of a comprehensive trading approach that considers multiple factors.

Ignoring Confirmation Signals: Failing to wait for confirmation signals before entering trades can result in premature entries or false breakouts. Validating SMC signals with additional confirmation from other indicators or price action patterns is important to enhance the reliability of trades.

Overtrading: Engaging in excessive trading based on every SMC signal without thorough analysis can reduce profitability and increase transaction costs. It’s essential to practice patience and discipline, taking trades only in alignment with a well-defined trading plan.

Lack of Adaptability: Markets are dynamic and continuously changing, and strategies that were effective in the past may not always work. It’s crucial to continuously adapt SMC strategies to evolving market conditions and refine trading approaches based on ongoing analysis and feedback.

Conclusion

In summary, Smart Money Concepts (SMC) equips forex market participants with a structured approach that centers on deciphering the maneuvers and motivations of market influencers, particularly institutional entities like banks and hedge funds. This methodology involves mirroring the trading behavior of influential players, with a focus on factors such as supply, demand dynamics, and market structure.

SMC introduces specialized terminology such as Order Blocks, Fair Value Gaps, and Liquidity, which serve as crucial components in analyzing market shifts using candlestick charts and technical analysis. These concepts harmonize with conventional trading principles and enhance comprehension of forex market dynamics, facilitating the development of effective trading strategies based on price action and forex signals.

The significance of “break of structure” (BOS) is pivotal in SMC market analysis within the forex market, where each rupture signifies a shift in market behavior. SMC traders leverage their understanding of these patterns to make informed decisions grounded in technical analysis and chart patterns.

In a comparative context, the roots of Smart Money Concepts can be traced back to Richard D. Wyckoff, a respected authority in the forex market. Wyckoff’s contributions to the Wyckoff Method underscore the importance of deciphering the intentions of “smart money” through technical analysis and forex signals. His concept of smart money mirrors that of SMC, and the Wyckoff Price Cycle illustrates analogous phases of accumulation, markup, distribution, and markdown.

Ultimately, both SMC and the Wyckoff Method furnish forex traders with invaluable insights into market dynamics, empowering them to make well-informed decisions predicated on technical analysis and forex signals. Mastery of these concepts and their applications can enhance one’s trading and investment strategies, fostering a more comprehensive and strategic approach to forex trading.