In the dynamic realm of the forex market, where fortunes are made and lost in the blink of an eye, understanding the nuances of currency pairs and identifying the most trendy ones can be the key to success. From scalping to swing trading, from technical analysis to fundamental insights, every aspect of trading is intertwined with the choice of currency pairs. In this comprehensive guide, we delve deep into the world of forex trading, exploring the most trendy currency pairs and unraveling the intricacies of market dynamics.

List Of Best Trending Currency Pairs

Amidst the vast array of currency pairs available for trading, certain pairs stand out for their propensity to exhibit strong trends. Let’s explore some of the most trendy currency pairs that attract traders’ attention across different trading sessions:

- EUR/USD: The Euro-US Dollar pair, also known as the “fiber,” dominates forex trading volumes, offering ample liquidity and tight spreads. Its popularity among traders stems from the economic significance of the Eurozone and the United States, as well as the pair’s tendency to exhibit prolonged trends.

- USD/JPY: The US Dollar-Japanese Yen pair, often referred to as the “ninja,” is renowned for its volatility and liquidity, making it a favorite among day traders and scalpers. Influenced by factors such as interest rate differentials and global risk sentiment, USD/JPY frequently presents lucrative trading opportunities.

- GBP/USD: The British Pound-US Dollar pair, commonly known as the “cable,” retains its allure due to the economic importance of the United Kingdom and the United States. Traders keen on swing trading and trend-following strategies find GBP/USD conducive to capitalizing on price trends.

- AUD/USD and NZD/USD: The Australian Dollar-US Dollar and New Zealand Dollar-US Dollar pairs, known as the “aussie” and “kiwi” respectively, exhibit strong correlations with commodity prices. As commodity currencies, AUD/USD and NZD/USD tend to trend in line with movements in commodity markets, presenting opportunities for trend-following traders.

- USD/CAD: The US Dollar-Canadian Dollar pair, dubbed the “loonie,” is heavily influenced by oil prices and economic developments in Canada and the United States. Traders seeking exposure to energy trends often turn to USD/CAD for trading opportunities.

Understanding the Significance of Trends in Forex Trading

In the world of forex trading, the direction of the trend holds paramount importance for traders seeking to optimize their trading outcomes. Trading in alignment with the prevailing trend serves as a potent tool for minimizing losses and maximizing profit potential, whether it’s a long position or a short position.

The Role of Trends in Minimizing Losses: Trading with the trend is a strategy widely embraced by traders across various experience levels. By aligning their trades with the direction of the trend, traders can mitigate the risk of incurring substantial losses. This approach is particularly favored by seasoned traders and professional daily traders who recognize the value of capturing price action in the direction of the prevailing bearish or bullish trend.

Challenges of Counter-Trend Trading: While counter-trend trading appeals to certain segments of traders, including seasoned professionals, it entails inherent risks and demands a high level of skill and adaptability. The frequent shifts in mindset required for successful counter-trend trading render it unsuitable for the majority of forex traders, who opt for trend-following strategies as a more reliable approach.

What Indicators To Use To Identify Trendy Currency Pairs

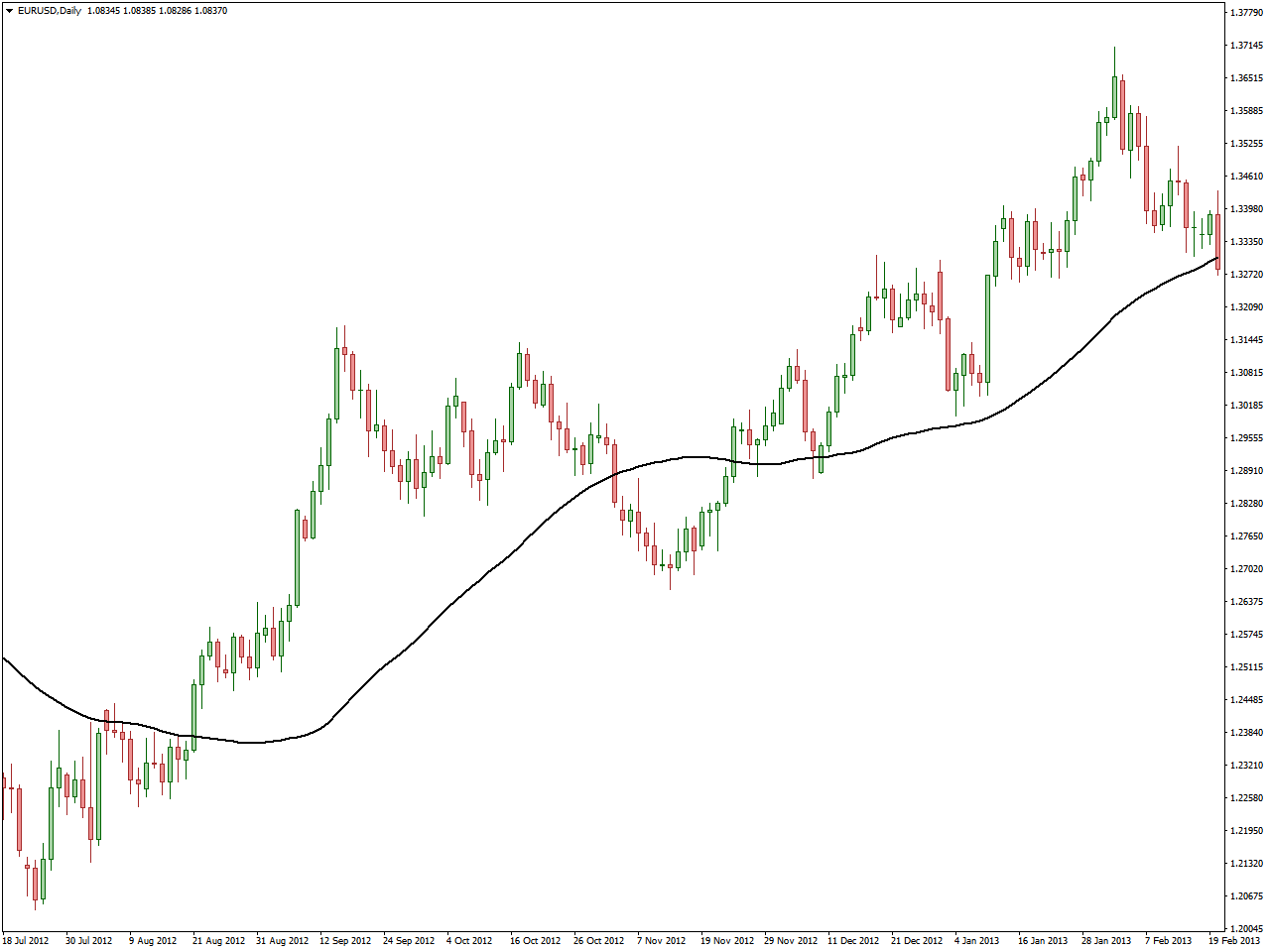

In the quest to identify trending forex currency pairs, intraday traders often rely on a variety of technical indicators to aid their analysis. Moving averages, such as the Simple Moving Average (SMA) or the Exponential Moving Average (EMA), are popular choices for trend identification. These indicators smooth out price data over a specified period, making it easier to discern the underlying trend direction.

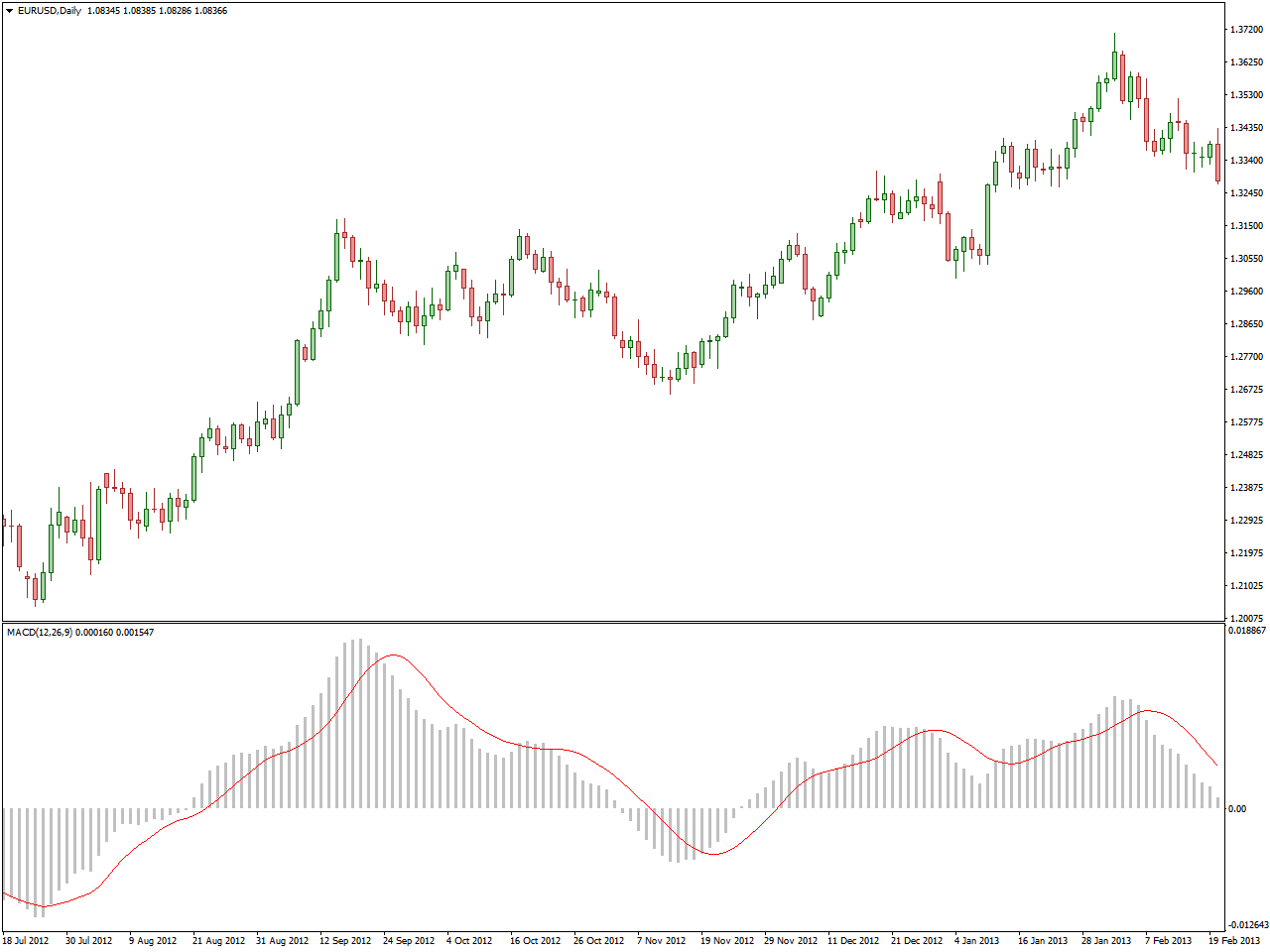

Additionally, oscillators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can provide valuable insights into the strength and momentum of a trend. Furthermore, trend-following indicators such as the Average Directional Index (ADX) can help traders gauge the strength of a trend and determine whether it is worth trading. By incorporating these technical indicators into their analysis, traders can enhance their ability to identify and capitalize on trending currency pairs effectively.

How to Find Trending Forex Currency Pairs Myself

Identifying trending forex currency pairs is a fundamental skill crucial for traders aiming to capitalize on buy or sell opportunities within the dynamic foreign exchange market. To effectively navigate this ever-changing landscape, traders rely on a combination of fundamental and technical analyses, alongside staying abreast of market news and sentiment. Fundamentally, comprehending major currencies and their price charts lays the groundwork for success. This entails monitoring key economic indicators such as GDP growth, employment figures, and central bank policies. Technical analysis tools like moving averages and trend lines play a pivotal role in identifying trends, while breakout and pullback patterns present potential entry points.

Market sentiment plays a crucial role, with risk-on sentiment favoring higher-yielding currencies and risk-off sentiment favoring safe-haven currencies. Additionally, observing relationships between currency pairs, particularly cross-currency pairs, provides further insights. Many trading platforms offer tools like trend indicators and market scanners, facilitating the identification of trending currency pairs. Staying informed through forex news websites and expert analysis reports helps traders stay ahead of market trends and potential catalysts for currency movements.

Practical Considerations for Trading Trendy Currency Pairs:

- Time Horizons: Different currency pairs may exhibit stronger trends over specific timeframes, necessitating alignment with traders’ preferred time horizons.

- Volatility and Liquidity: Consideration of volatility and liquidity is paramount when trading trendy currency pairs, as these factors impact the ease of entry and exit from trades.

- Correlation and Economic Factors: Understanding currency correlations and monitoring economic calendars for key events can aid in identifying potential trends and anticipating market movements.

Conlusion

The choice of currency pairs plays a crucial role in shaping trading outcomes, exerting a substantial impact on profitability. By integrating technical analysis and implementing robust risk management techniques, including the strategic use of stop-loss order and take-profit order, traders can effectively navigate the complexities of the forex market. Furthermore, staying attuned to market sentiment enables traders to capitalize on opportunities presented by trending currency pairs. Whether you’re a seasoned traders or a beginners embarking on your forex journey, mastering the art of trading in popular currency pairs is essential for achieving success in this fast-paced and exhilarating field. However, it’s important to acknowledge the inherent risks associated with trading, necessitating the adoption of comprehensive money management strategies. By strategically placing stop-loss orders and take-profit orders, traders can mitigate potential losses and optimize their risk-reward ratio. Additionally, identifying the best positions using technical analysis and adhering to disciplined risk management strategies are vital steps in safeguarding capital and maximizing profitability in forex trading.