In the dynamic world of Forex trading, understanding the correlations between currency pairs is essential for traders striving for success. As the Forex market operates under the influence of various factors, the relationships among different currency pairs significantly impact market dynamics.

This article aims to demystify currency pair correlations, shedding light on how these connections can be strategically harnessed to enhance the precision of trading decisions. At its core, currency pair correlation involves grasping the extent to which the movement of one currency is intertwined with another, enabling traders to assess potential market trends, diversify portfolios, and manage risks effectively. From the euro and the US dollar to the Japanese yen and the Australian dollar, these correlations provide valuable insights for traders navigating the challenges of the Forex market.

This exploration delves into diverse correlation categories, historical patterns, and factors influencing their fluctuations, empowering traders to formulate resilient strategies aligned with the ever-evolving dynamics of Forex. Join us on this odyssey as we unravel the complexities of currency pair correlations, unlocking the potential for more discerning and strategic trading decisions.

Why its important to know correlation of currency pairs in forex?

Comprehending the correlation among currency pairs within the Forex market is crucial for traders, serving as a guiding force to navigate the intricate landscape of currency fluctuations. First and foremost, it yields valuable insights into potential market trends. As traders discern how specific currency pairs move in relation to each other, they gain the ability to formulate more insightful predictions about the future trajectory of the market. This knowledge equips them to anticipate potential opportunities or risks, fostering a proactive approach to decision-making.

Moreover, an understanding of currency pair correlations is pivotal for effective risk management and portfolio diversification. Highly correlated currency pairs often move in sync, meaning that a shift in one pair is likely to be mirrored in another. Armed with this information, traders can strategically diversify their portfolios, thereby diminishing overall risk exposure. Conversely, a grasp of negative correlations enables traders to identify hedges against potential losses, providing a protective layer during periods of heightened market volatility.

Lastly, the ability to recognize currency pair correlations empowers traders to optimize their trading strategies. By aligning positions with correlated or uncorrelated pairs based on prevailing market conditions, traders can elevate the overall efficiency of their portfolios. This strategic approach facilitates a more dynamic response to evolving market dynamics, fostering adaptability and resilience in the face of changing economic and geopolitical factors. In essence, a nuanced understanding of currency pair correlations stands as a foundational element for informed decision-making, risk mitigation, and the cultivation of robust and adaptive trading strategies in the dynamic realm of Forex.

Forex Correlation Pairs List

Here is the list of some positive correlation pairs:

- EUR/USD and GBP/USD

- AUD/USD and NZD/USD

- USD/JPY and USD/CHF

- EUR/GBP and EUR/AUD

- GBP/AUD and GBP/NZD

- USD/CAD and AUD/USD

- EUR/JPY and GBP/JPY

- NZD/USD and AUD/NZD

In positive correlation scenarios, when one currency pair strengthens, the other tends to strengthen as well. Traders often use this information for risk management and diversification, understanding that movements in one pair may be mirrored in the correlated pair. However, it’s crucial to note that correlations can change, and traders should regularly monitor and adapt their strategies accordingly.

A simple example of positive correlation – AUD/USD and NZD/USD

Some examples of negative correlation pairs:

- EUR/USD and USD/CHF

- GBP/USD and USD/JPY

- AUD/USD and USD/CAD

- EUR/GBP and GBP/USD

- GBP/JPY and USD/JPY

In negative correlation scenarios, when one currency pair strengthens, the other typically weakens, and vice versa. Traders may use these negative correlations for risk management and to identify potential hedging opportunities. As with positive correlations, it’s essential to monitor these relationships regularly, as correlations can shift due to changing market conditions, economic factors, or geopolitical events.

Example of negative correlation – EUR/USD and USD/CHF

Pros&Cons

Trading with correlated currency pairs in Forex can offer both benefits and drawbacks, and it’s essential for traders to carefully consider these factors in their decision-making process.

Benefits:

- Risk Diversification: Correlated currency pairs can provide an avenue for risk diversification. If a trader holds positions in two positively correlated currency pairs, a gain in one may offset a potential loss in the other, helping to manage overall portfolio risk.

- Hedging Opportunities: Understanding negative correlations can offer hedging opportunities. When one currency pair is showing weakness, traders may seek refuge in a negatively correlated pair to offset potential losses.

- Enhanced Decision-Making: Correlation analysis can provide additional insights for decision-making. Recognizing how different currency pairs move in relation to each other allows traders to make more informed predictions about market trends and adjust their strategies accordingly.

Drawbacks:

- Overreliance on Correlations: Relying too heavily on correlations can be risky. Market conditions and correlations are dynamic and subject to change, especially during periods of economic events or crises. Overreliance on historical correlations may lead to misjudgments.

- False Correlations: Traders should be cautious about false correlations, where apparent relationships break down unexpectedly. Economic events, geopolitical changes, or shifts in market sentiment can cause correlations to shift, leading to unexpected outcomes.

- Reduced Profit Potential: While correlations can mitigate risk, they may also limit profit potential. Positive correlations, for example, mean that gains in one pair are likely to be mirrored in another. While this aids risk management, it may also cap overall profit potential.

How does correlation help in trading with FXSSI indicators?

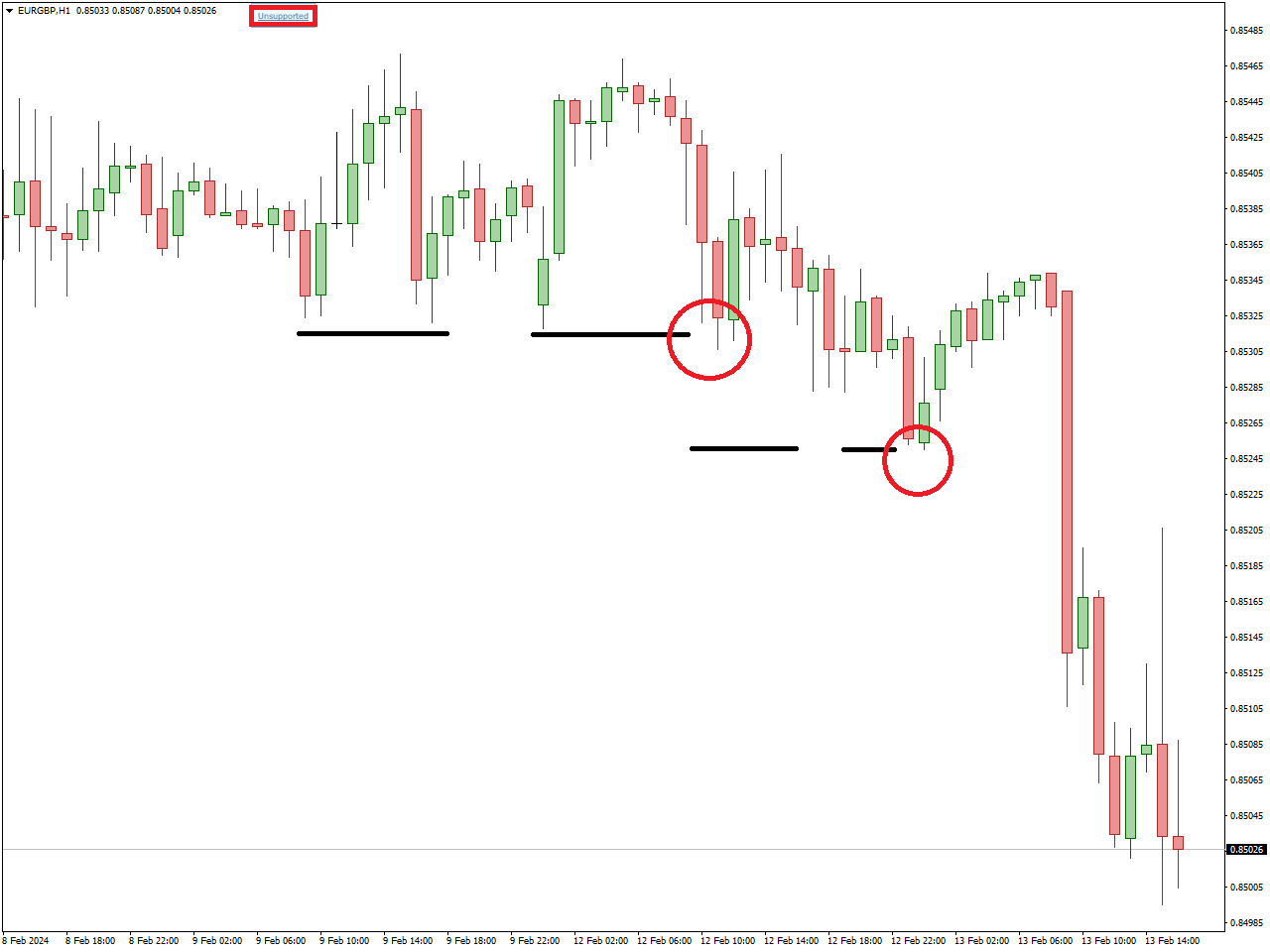

In order to make profit from currency correlation you can use FXSSI.StopLossClusters Indicator for identifying trend reversal points. Or, for example, you can use it on specific currency pair which is not supported by FXSSI.StopLossClusters Indicator and has correlation with supported one.

Lets take a look on EUR/GBP and GBP/USD example:

While the indicator may not be relevant to the cross pair EUR/GBP, there is a negative correlation between this pair and the GBP/USD. Therefore, when there is a shift in the Dollar’s direction, I receive a signal indicating a high probability of a directional change in cross pairs like EUR/GBP.

Conclusion

In the intricate domain of Forex trading, unraveling the correlations between currency pairs reveals profound insights that can reshape the trading landscape. This exploration highlights that these interconnections transcend mere statistical relationships, emerging as indispensable tools for strategic decision-making. Beyond predicting individual currency movements, successful Forex trading hinges on deciphering the intricate web of connections binding them together.

Currency pair correlations offer traders a holistic perspective, empowering them to navigate market volatility with heightened precision. Emphasizing risk diversification and portfolio optimization, the strategic application of this knowledge fosters a more robust and adaptive approach to the ever-evolving Forex environment.

As traders bid adieu to this exploration, the enduring significance of continual analysis, adaptability, and a nuanced comprehension of currency pair correlations stands as a guiding beacon amidst the dynamic fluctuations of the global foreign exchange market.