There are pros and cons to both approaches. Price action trading allows traders to get a better understanding of the underlying market dynamics and can be less subjective than indicator-based trading. However, it requires a lot of practice, patience, and discipline to master, and it can be difficult to implement for novice traders.

Indicator-based trading can be easier to learn and more accessible to novice traders, but it can also be more subjective, and the signals generated by the indicators can sometimes be misleading, leading to losses.

Let’s first define each trading method, its pros and cons and then discuss which is better – price action or indicator?

What is Price Action Trading?

Price action is trading without any technical indicators. It is a form of technical analysis that focuses on identifying chart patterns, support and resistance levels, and other market dynamics to make trading decisions.

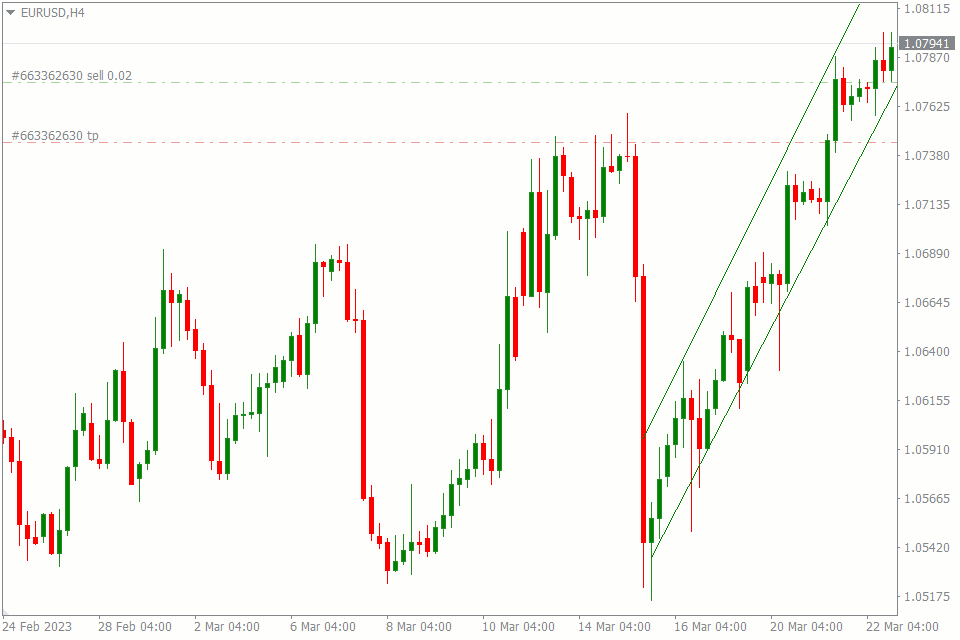

As you can see, there are no technical indicators on the chart above, and support and resistance levels are drawn manually.

Price action traders believe that all the information needed to make informed trading decisions can be found in the price movements of a currency pair. They rely on the concept that price movements reflect all the underlying fundamentals of an asset, including supply and demand, economic indicators, geopolitical events, and other factors.

Price action traders use a range of tools and techniques to analyze price movements, including:

- Candlestick patterns (Doji, engulfing, etc).

- Chart patterns (1-2-3, Heads and Shoulders, etc).

- Trendlines.

- Support and resistance levels.

Price action trading requires a lot of practice, patience, and discipline to master. Traders who use this approach must develop a keen sense of observation, learn to read the price movements accurately, and be able to react quickly to changes in the market. However, for those who can master price action trading, it can be a powerful tool for making informed trading decisions and achieving success in forex trading.

Advantages of Price Action Trading

Price action trading has several advantages over other types of trading strategies. Here are some of the main advantages of price action trading:

- Price action trading is a simple and straightforward approach to trading that does not rely on complicated indicators or algorithms. Instead, it focuses on analyzing the movements of the price of a currency pair to identify trends, support and resistance levels, and other chart patterns.

- Price action trading can provide accurate signals for entering and exiting trades, as it is based on the actual movements of the price of a currency pair.

- Price action trading can help traders manage risk by identifying key levels of support and resistance and setting appropriate stop-loss orders. This can help traders limit their losses and preserve their capital.

Price action trading is a powerful tool for making informed trading decisions and achieving success in the markets. It is a simple and flexible approach that can be used by traders of all experience levels to improve their trading results.

Disadvantages of Price Action Trading

While price action trading has many advantages, it also has some potential disadvantages that traders should be aware of. Here are some of the main disadvantages of price action trading:

- Price action trading can be highly subjective, as it relies on a trader’s interpretation of the movements of the price of a currency pair. Different traders may see different patterns and draw different conclusions, which can lead to inconsistent results.

- Price action trading can take a long time to master, as it requires a lot of practice and experience to learn to read price movements accurately and make informed trading decisions.

- Price action trading requires patience and discipline, as traders must wait for the right signals to develop before entering or exiting trades. This can be difficult for traders who are prone to impulsive or emotional decision-making.

- Price action trading can be less effective in highly volatile or choppy market conditions, where the movements of the price of a currency pair may be less predictable.

What is Indicator-Based Trading?

Indicator-based trading is a method of technical analysis used in forex trading that involves using technical indicators to analyze the markets and identify potential trading opportunities. Technical indicators are mathematical calculations based on price and volume data that generate signals that traders can use to enter or exit trades.

There are many types of technical indicators that traders can use, including:

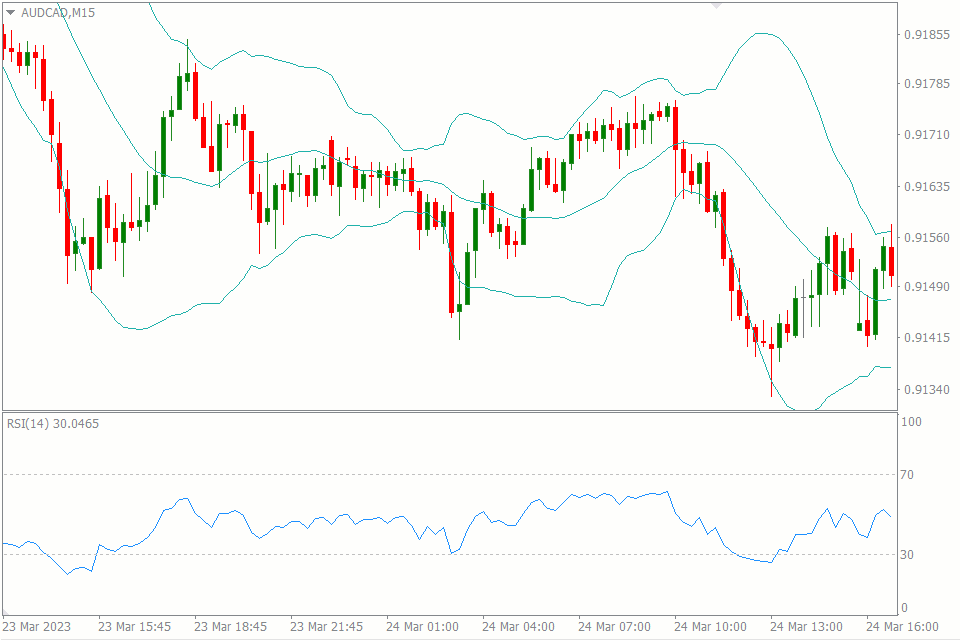

- Moving averages.

- RSI.

- MACD.

- Bollinger Bands and other.

In the chart below you can see a combination of the two indicators – Moving averages, RSI.

Indicator-based trading can be useful for traders who prefer a more systematic approach to trading and want to take emotions out of the decision-making process. It can also be helpful for novice traders who are still developing their trading skills and need guidance in identifying potential trading opportunities.

Advantages of Indicator-Based Trading

Indicator-based trading has several advantages. Here are some of the main advantages of indicator-based trading:

- Indicator-based trading is based on objective analysis of past price and volume data, which can help traders to make more informed trading decisions. This can help to reduce the impact of emotions and biases on trading decisions.

- Technical indicators generate clear signals for traders to enter or exit trades, which can help traders to make quick and decisive trading decisions.

- Technical indicators can help traders to manage risk by identifying key levels of support and resistance and setting appropriate stop-loss orders.

- Indicator-based trading can be used with any trading instrument and time frame, which makes it highly scalable. This can be helpful for traders who want to trade multiple markets or time frames simultaneously.

Indicator-based trading is a powerful tool, which can be used by traders of all experience levels to improve their trading results.

Disadvantages of Indicator-Based Trading

While indicator-based trading has many advantages, it also has some potential disadvantages that traders should be aware of. Here are some of the main disadvantages of indicator-based trading:

- Technical indicators are based on past price and volume data, which means that they can be lagging indicators of future price movements.

- Traders who rely too heavily on technical indicators may overlook other important factors that can influence the markets, such as news events or market sentiment.

- Technical indicators can generate false signals, which can lead to losing trades.

Differences Between Price Action and Indicator-Based Trading

For novice forex traders, indicator-based trading is faster and easier to learn than price action trading. It is important to note that “easier”, “faster”, and “more profitable” are not necessarily synonyms.

Indicators are automatically drawn on the chart and are therefore often objective. They are independent of trader interpretations and have their own meanings.

Traders draw price action patterns. Therefore, signals that are developed depend on how the trader interprets what they have drawn.

Many indicators are calculated using specific prices such as the closing and opening prices for certain periods. For example, moving averages use the closing and opening prices for a number of periods to plot their lines.

Price action tools can sometimes do this, but they rely more heavily on visual patterns. For example, a pair may be in an uptrend because the candlesticks look up.

Indicators vs Price Action: Which is Better?

There is no definitive answer as to which approach is better – indicators or price action – as both have their advantages and disadvantages, and the choice between the two ultimately depends on the trader’s individual trading style, preferences, and experience level.

Price action trading can be more subjective and requires experience and knowledge to interpret and make trading decisions. It requires the trader to analyze the price movements of a currency pair and identify patterns and trends, which can be time-consuming but can also provide valuable insights into the market.

On the other hand, indicator-based trading is more objective and relies on predefined technical indicators to generate trading signals. It can be easier to implement and can provide clear signals for entry and exit points, but it can also be subject to false signals and lagging indicators.

Some traders prefer to use a combination of both approaches, using technical indicators to confirm or supplement their price action analysis. This can provide a more well-rounded view of the market and help to reduce the risk of false signals or missed trading opportunities.

Ultimately, the choice between indicators or price action will depend on the trader’s individual preferences and trading style. It is important to do your own research and testing to find the approach that works best for you.

Bottom Line

If you’re asking which of the two approaches to technical trading on Forex to use, you may be focusing on the wrong thing. Because we recommend that you use both approaches. Use the strengths of one to complement the weaknesses of the other.