In the fast-paced realm of Forex trading, anticipating market trends is vital for achieving success. Traders often employ a potent strategy – maneuvering through the complex terrain of news events. Successfully trading the news in Forex demands a methodical approach that merges analytical skills with a profound comprehension of market reactions. This article is designed to lead you through the fundamental aspects of proficient news trading, enabling you to seize potential opportunities while adeptly handling associated risks. Whether you’re a novice or seasoned trader, delving into the nuances of news trading can markedly augment your trading toolkit.

What is the Duration of News Impact on the Market?

The duration during which news influences the market can vary significantly, influenced by multiple factors. Typically, the impact of news on the market is most pronounced immediately following its release. This initial reaction, commonly known as the “immediate market response” or “price spike,” can occur within seconds to minutes after the news becomes public.

Nevertheless, the enduring effects of news may extend over a more prolonged period, ranging from hours to days. This duration depends on the significance and nature of the news event. Events such as major economic indicators, geopolitical developments, or unexpected corporate news can exert a lasting influence on market sentiment and trading activity.

It’s crucial to recognize that markets are dynamic, with participants consistently reassessing information. Over time, the initial impact of news may be tempered or strengthened by subsequent developments, economic data releases, or shifts in investor sentiment. Traders and investors should remain vigilant, continually monitor evolving conditions, and adapt their strategies accordingly in response to ongoing market dynamics.

What are the benefits?

Engaging in the trading of news releases presents numerous advantages for participants in the financial markets:

- Opportunities in Volatility:

News releases frequently generate heightened market volatility. Traders can leverage these fluctuations in prices during such events, creating opportunities for profitable outcomes. Volatile periods may offer favorable conditions for swift and decisive trading. - Potential for Swift Profits:

The rapid market movements triggered by news releases can open avenues for quick profit opportunities. Traders capable of making well-timed decisions based on the news may potentially benefit from short-term price changes. - Capitalizing on Market Momentum:

Positive news can instigate bullish market momentum, while negative news can initiate a bearish trend. Traders can align their positions with the prevailing market sentiment, allowing them to ride the momentum for potential gains. - Informed Decision-Making:

News releases furnish valuable information regarding economic indicators, corporate performance, or geopolitical events. Traders who stay well-informed can make more educated decisions, possessing a clearer understanding of the factors influencing the market. - Diversification Opportunities:

Engaging in the trading of news releases permits the diversification of trading strategies. Traders can integrate both fundamental and technical analysis to make well-rounded decisions, leveraging a broader array of tools and approaches. - Adaptability to Short-Term Trends:

News releases frequently impact short-term price trends, providing opportunities for traders who prefer shorter holding periods. This adaptability allows traders to tailor their strategies to different market conditions. - Heightened Trading Volume:

News events have the potential to draw additional market participants, resulting in increased trading volume. Elevated liquidity can facilitate smoother trade execution and potentially reduce slippage.

While trading news releases can be profitable, it is crucial to recognize the associated risks. Markets can exhibit high unpredictability during these events, and sudden price action may lead to substantial losses. Traders should exercise caution, implement risk management strategies, and thoroughly comprehend the potential impacts of the news they are trading.

Drawbacks

While news trading offers various benefits, it is essential to be aware of potential drawbacks and risks associated with this strategy:

- Market Volatility: News events can trigger significant and unpredictable market volatility. Sudden and sharp price movements may lead to increased slippage, making it challenging to execute trades at desired prices.

- Spread Widening: During major news releases, brokers may widen spreads to account for increased market uncertainty. This can affect trading costs and potentially reduce profit margins for traders.

- Unpredictable Market Reactions: Market reactions to news can be unpredictable. Even if the news appears positive, the market may react negatively, and vice versa. Traders may face challenges in accurately forecasting how the market will interpret and respond to news.

- False Breakouts: News-driven price movements can sometimes result in false breakouts. Traders may experience situations where prices briefly breach support or resistance levels but fail to sustain these levels, leading to losses for those who entered trades based on the initial breakout.

- Limited Control During Fast Markets: In highly volatile market conditions, it may be challenging to maintain control over trades. Fast markets can lead to rapid price changes, making it difficult to execute trades or implement risk management strategies effectively.

- Slippage: Due to increased volatility, traders may experience slippage, where trades are executed at a different price than expected. This can result in additional trading costs and impact overall profitability.

- Overtrading: The allure of quick profits from news trading may lead some traders to overtrade, increasing the likelihood of making impulsive decisions and risking larger portions of their capital.

- Timing Challenges: Successfully trading news requires precise timing. Traders need to react quickly to news releases, and delays in execution can lead to missed opportunities or unfavorable trade outcomes.

- Information Overload: Keeping up with various news sources and staying informed about multiple events can be overwhelming. Traders may find it challenging to filter relevant information from noise and make informed decisions.

- Emotional Stress: The fast-paced nature of news trading can induce stress and emotional reactions. Traders may be more prone to making impulsive decisions under pressure, leading to suboptimal trading outcomes.

To navigate these drawbacks successfully, traders engaging in news trading should exercise caution, implement robust risk management strategies, stay well-informed, and continuously refine their skills. It’s crucial to understand that news trading requires a disciplined approach and a thorough understanding of the potential challenges involved.

How to trade Forex news using FXSSI.Calendar

FXSSI.Calendar is a tool that provides information on economic events and news releases that can impact the Forex market. Trading Forex news requires careful analysis and risk management. Here’s a step-by-step guide on how to trade Forex news using FXSSI.Calendar:

- Access FXSSI.Calendar:

- Visit the FXSSI website and go to the Calendar section.

- Understand the Economic Events:

- Familiarize yourself with the economic events listed on the calendar. Events are often categorized by their potential impact on the market (low, medium, high).

- Select Important Events:

- Focus on high-impact events, such as interest rate decisions, employment reports, GDP releases, and central bank statements.

- Analyze Market Expectations:

- Check the forecasted values for each economic indicator. Market expectations play a crucial role in how prices react to news releases.

- Monitor Previous Data:

- Look at the previous data and compare it with the forecast. A significant difference between the forecast and the actual release can lead to market volatility.

- Identify Market Sentiment:

- Gauge the current market sentiment by analyzing price action and other technical indicators leading up to the news release.

- Prepare Trading Plan:

- Based on your analysis, create a trading plan that includes entry and exit point, stop-loss order, and take-profit order. Consider the potential impact of slippage and high volatility.

- Use Risk Management:

- Set appropriate risk-reward ratio for your trades. Avoid risking more than a small percentage of your trading capital on a single trade. Consider using stop-loss orders to limit potential losses.

- Be Ready for Volatility:

- News releases can lead to rapid price movements and increased volatility. Be prepared for market fluctuations and slippage.

- Execute Trades with Caution:

- Enter the market cautiously, ideally after the initial market reaction has occurred. Be mindful of spread widening and possible liquidity issues during volatile periods.

Remember that trading news carries inherent risks, and it’s crucial to have a well-thought-out strategy, proper risk management, and a good understanding of the market conditions.

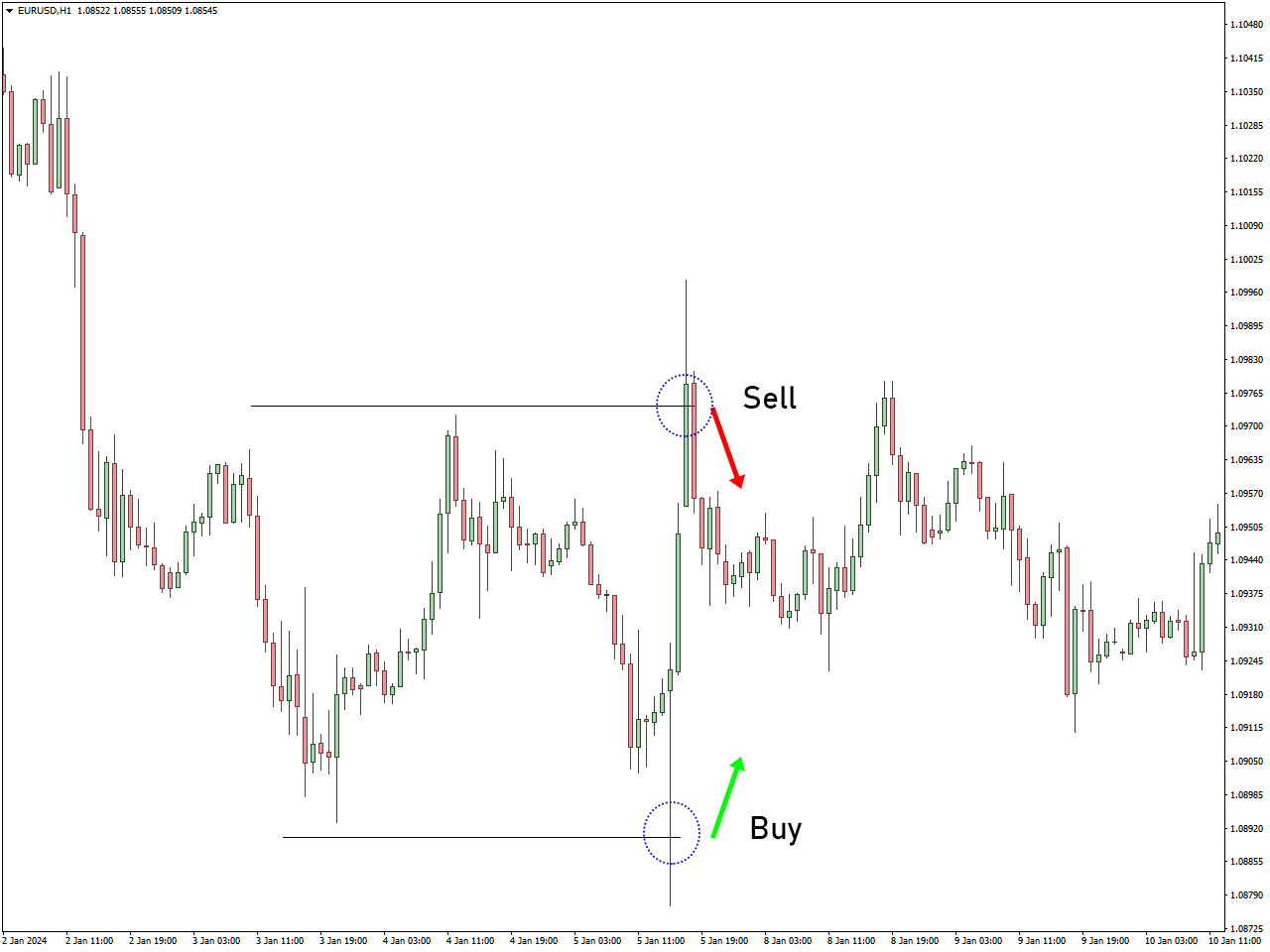

In the provided illustration involving the EUR/USD currency pair, we observe the tangible impact of news on market volatility. This scenario underscores the significance of incorporating news events into one’s trading strategy, as they can serve as pivotal entry points for traders.

Analyzing the EUR/USD example in greater detail, it becomes evident that news releases can act as catalysts, influencing the direction and momentum of the market. The observed volatility following a significant news event serves as a dynamic opportunity for traders to execute well-informed entries. This emphasizes the importance of staying attuned to economic calendars and news feeds, enabling traders to anticipate market movements and strategically time their trades. Consequently, incorporating news-driven analysis into trading strategies becomes an essential component for those seeking to navigate the complexities of the Forex market with a heightened level of precision and responsiveness.

How Does the Indicator Warn Of Upcoming Volatility?

In the course of their trading careers, every trader has encountered situations where abrupt volatility triggered the Stop Loss of a recently opened trade. Subsequently, it becomes evident that the surge in volatility was attributed to the release of certain macroeconomic statistics.

Regardless of the specific trading strategy one employs, acknowledging and incorporating the impact of important news releases is imperative. Developing a personalized plan of action for such scenarios is essential. For instance, considerations may include closing a trade if the anticipated volatility exceeds predefined target levels significantly. Alternatively, implementing hedging strategies, such as securing trades 10 minutes prior to a news release and unlocking the position when the market stabilizes, can be a proactive approach. Another recommendation is to refrain from resuming trading until at least 15 minutes post-release. By adopting such precautionary measures, traders can safeguard themselves against unforeseen losses when factoring in news-related events.

In the provided illustration, heightened volatility becomes apparent following the dissemination of news. This presents an opportune moment for strategic trading, wherein one can capitalize on the increased market activity. By strategically initiating trades from resistance levels during such periods, traders can align their positions with the prevailing market dynamics, potentially enhancing the likelihood of favorable outcomes.

In leveraging this approach, traders can employ a proactive strategy that takes advantage of the price movements triggered by the news release. Identifying and acting upon resistance levels serves as a tactical entry point, allowing traders to navigate the heightened market volatility with a well-considered plan. This approach not only acknowledges the impact of news on market behavior but also positions traders to make informed decisions during these periods of increased turbulence.

Conlusion

As we wrap up our investigation into Forex news trading, it becomes clear that maintaining awareness and adaptability in response to market-moving events is paramount for achieving success. Embracing a disciplined methodology, comprehending market sentiment, and employing effective risk management strategies enable traders to navigate the unpredictable terrain of news-driven markets. It’s important to note that news trading presents challenges, yet with persistent practice and ongoing learning, one can leverage its potential to make well-informed decisions and enhance overall trading results. Integrate these valuable insights into your trading toolkit, tailoring them to your individual style for a more robust and gratifying day trading expedition.