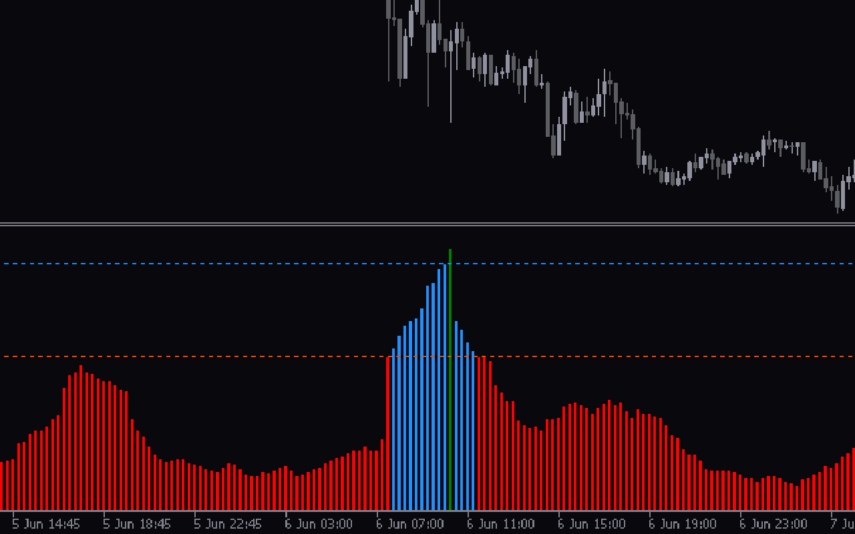

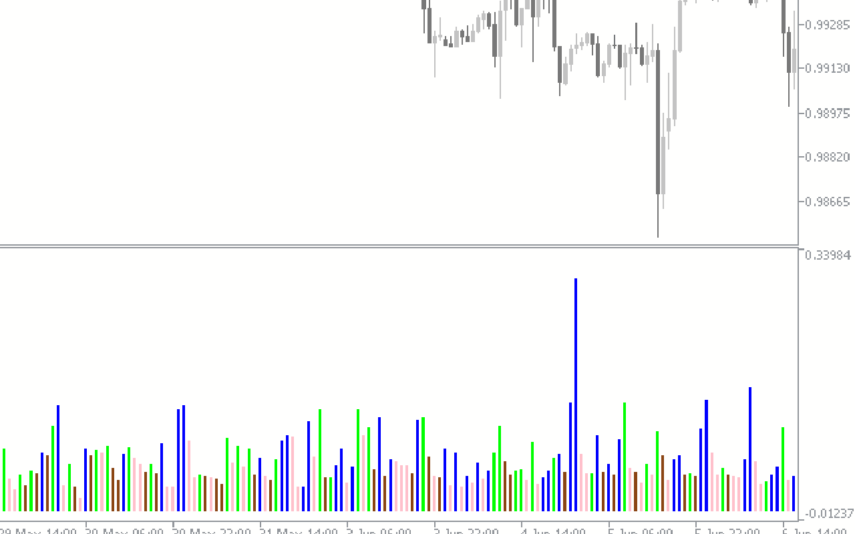

Volume indicators are crucial analytical tools utilized in trading to assess the quantity and significance of market activity. These indicators offer insights into the intensity of buying and selling pressure within a given asset or market, aiding traders in identifying potential shifts in sentiment and market trends. By analyzing trading volume alongside price data, traders can make well-informed decisions and anticipate market movements with greater accuracy, enhancing their overall trading strategy and performance.