Showing all 8 results

Bolt Alian Job Stochastic

Bolt Alien Job Stochastic Indicator is a useful forex indicator for MT4 that is popular among traders. It is a free indicator that helps identify overbought and oversold conditions in the market. Traders can use this indicator to make informed decisions on when to enter or exit trades. It works by analyzing price movements and providing signals based on Stochastic oscillator readings.

CHT Value Chart V 2 5 3

The CHT Value Chart v2.5.3 indicator is a popular and free forex indicator for MetaTrader 4 (MT4) that is useful for traders of all levels. This indicator is designed to help traders identify potential reversal points in the market, as well as support and resistance levels. It is based on the average true range (ATR) of a given currency pair, and uses a range of values to identify areas of potential support or resistance. It is a great tool for traders who want to get a better understanding of the market and make more informed trading decisions.

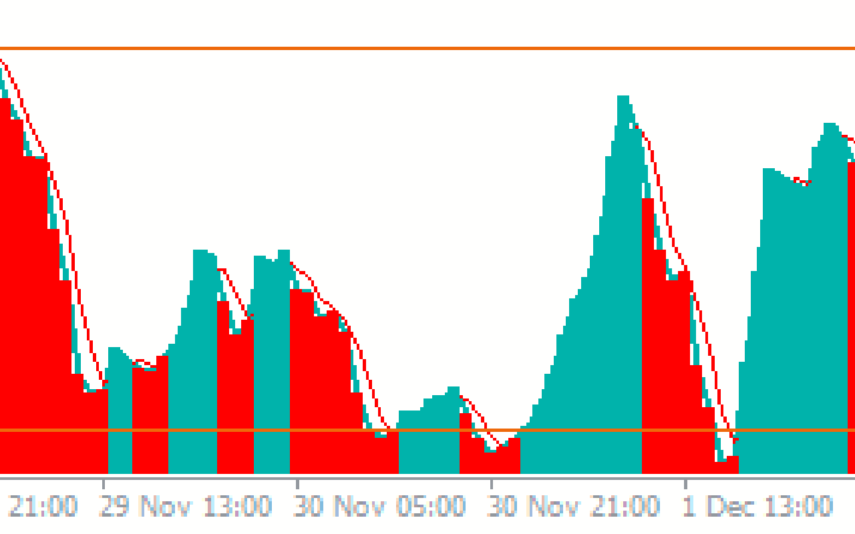

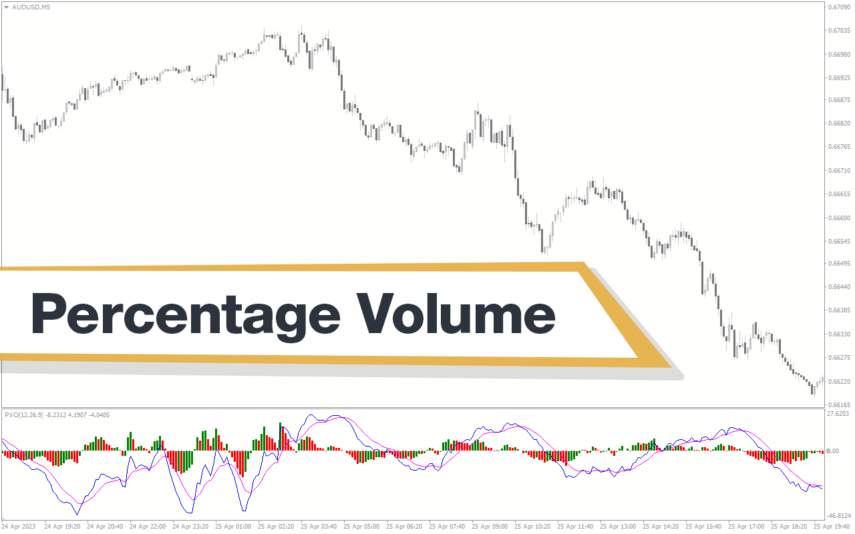

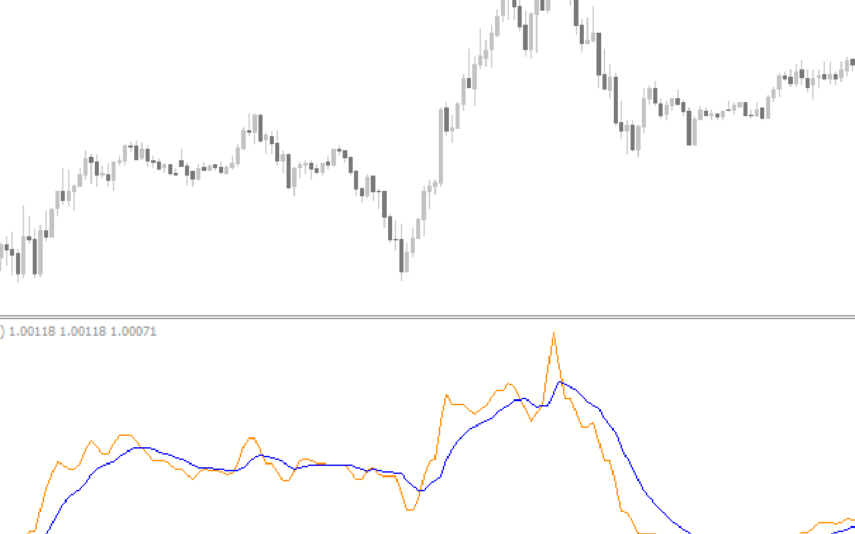

Percentage Volume Oscillator

The Percentage Volume Oscillator (PVO) is a popular and free forex indicator for the MetaTrader 4 (MT4) trading platform. It is useful in measuring the strength of a trend by comparing the volume of a particular period to the volume of the previous period. It is calculated by subtracting the 26-period exponential moving average (EMA) of volume from the 12-period EMA of volume. The PVO can be used to identify potential reversal points in the market, as well as possible breakouts and trend continuation signals.

Positive Volume Index

The Positive Volume Index (PVI) is a popular and useful Forex indicator that is available for free on the MT4 trading platform. The indicator works by comparing the current day’s volume to the previous day’s volume. If the current day’s volume is higher than the previous day’s volume, then the Positive Volume Index is increased. If the current day’s volume is lower than the previous day’s volume, then the Positive Volume Index is decreased. The Positive Volume Index is a great tool for traders of all levels and can be used to help identify potential trading opportunities.

RSI TS Indicator

The RSI-TS Indicator is a popular and useful Forex indicator for the MT4 trading platform. The indicator is based on the Relative Strength Index (RSI) and uses advanced trend analysis to identify potential trading opportunities. The indicator is a great tool for traders of all levels, and can help identify profitable trading opportunities in the Forex market.

TIB Indicator

TLB Indicator is a useful forex indicator for MT4 that has become popular among traders. This free tool utilizes trend line break signals to identify potential trade opportunities in the market. By plotting trend lines on the chart, traders can easily spot key levels of support and resistance to make informed trading decisions. Learn more about how to use TLB Indicator effectively for your trading strategy.

Volume MA

The Volume MA Indicator is a useful and popular free Forex indicator for MT4. It uses the volume of a currency pair to identify overbought and oversold conditions. The indicator uses the moving average of the volume of a currency pair to determine the trend. When the moving average is above the average, it indicates an uptrend. Conversely, when the moving average is below the average, it indicates a downtrend. By using this indicator, traders can identify potential entry and exit points in the market.

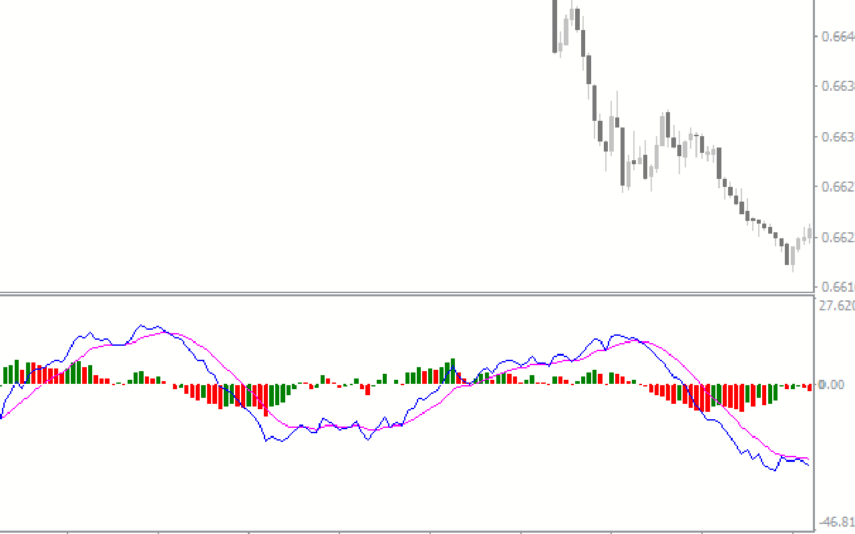

Weis Volume

Discover Weis Wave Volume Indicator for MT4, a free tool by David Weis. Spot market openings & trends with wave-like volume patterns. There are no simple buy/sell signals but insights on demand & supply strength. The indicator is easy to use and is a great tool for any trader looking to gain insight into the market.

Volume indicators are crucial analytical tools utilized in trading to assess the quantity and significance of market activity. These indicators offer insights into the intensity of buying and selling pressure within a given asset or market, aiding traders in identifying potential shifts in sentiment and market trends. By analyzing trading volume alongside price data, traders can make well-informed decisions and anticipate market movements with greater accuracy, enhancing their overall trading strategy and performance.